The President of the Republic committed to this during his major press conference on January 16. Middle-class French people will benefit from a tax cut of 2 billion euros in 2025. But who are we talking about exactly? This is what the Institut Montaigne, a think tank, tried to clarify in a study published this Wednesday, January 24.

If two thirds of French people thought they would be part of it in 2023, according to a study by the Jean-Jaurès Foundation, the “middle class” remains a notion with vague contours. And for good reason, “no definition currently makes it possible to represent, in a fair and consensual manner, the “French middle class(es)”, explains Lisa Thomas-Darbois, deputy director of French studies at the Institut Montaigne.

1 in 2 French people are part of the middle class

For the researcher, income would be a first avenue. Or at least, would make it possible to delimit the “middle class” between the 30% most modest French people and the 20% richest French people. However, it would be wrong to consider the middle class as a homogeneous entity, to the extent that strong income disparities coexist within this category which represents half of the French population. This is why the researcher prefers to conjugate the term “middle classes” in the plural.

It aligns with the database published by the Crédoc research center, which separates the middle classes into two categories, lower and upper. 30% of French people would belong to the first, with an income of between 1,440 and 2,260 euros per month. And the remaining 20% would thus be made up of upper-middle-class French people, whose monthly income fluctuates between 2,260 and 3,110 euros. Lisa Thomas-Darbois speaks of a “bipolarization of the middle class”, the result, according to her, of “a less rapid progression of middle class income compared to the median standard of living”.

The fear of social downgrading

The author of the report notes a “fear” of the future common to all the middle classes, which can be explained in particular by an increase in constrained expenses (also called “pre-committed” expenses, for example linked to housing or insurance). According to the OECD, housing represented almost a third of the budget of the middle classes in 2019, a share which has increased considerably since the beginning of the 2000s. “New generations are now less likely to be part of the middle classes than previous generations due to a downward trend in middle incomes”, estimates the Institut Montaigne.

The middle classes share the fear of social downgrading: “This fear of losing, much more than it is statistically possible to lose, is an inherent characteristic of the middle classes,” explains Lisa Thomas-Darbois. However, the author underlines the strong attachment of the middle classes to institutions and meritocracy. In an Ipsos survey carried out in 2023, 59% of middle-class people declared they had “rather confidence” in school, compared to 53% of the population belonging to the working and disadvantaged classes and 43% of the privileged and wealthy classes.

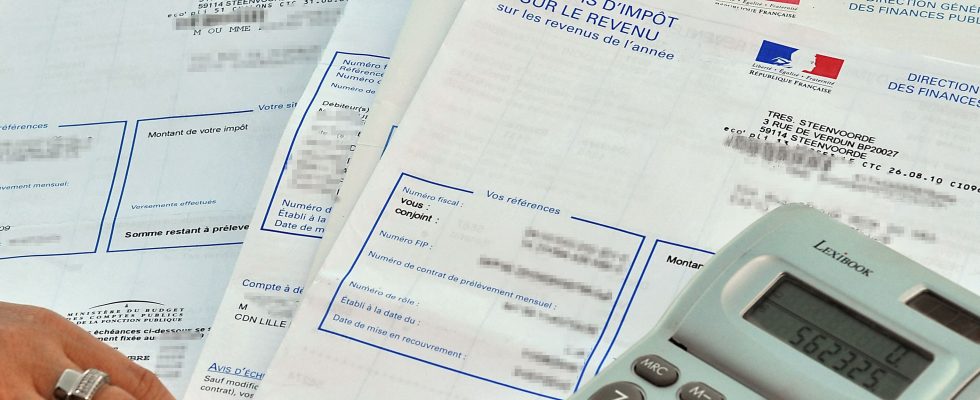

The feeling of tax injustice

This, despite a feeling of injustice which persists and tends to increase. That of contributing without really receiving in return: “The middle classes are those for whom the benefit of redistribution tends to be canceled out in relation to the contributions paid”, points out the study by the Montaigne Institute, which reveals that the share of beneficiaries of redistribution is less than 50% for people at the median standard of living, while it is 85% for the lowest 30% of individuals.

However, “the contributing force of the middle classes in the redistribution system is a reality”, underlines Lisa Thomas-Darbois. Middle-class French people alone represent 40% of tax households and contribute to direct taxes to the tune of 100 billion euros per year. That is almost five times more than the working classes.