What if, when it comes to debt, the bomb was also American? While in France, the consolidation of public accounts has become a subject as political as it is economic, across the Atlantic, too, the question could be invited in the race for the White House. The attack started from the CBO, the Congressional Budget Office, a federal agency financed by the American Congress, responsible for assessing the situation of public finances and making medium and long-term projections. In its latest delivery, the CBO drops its punches: “If nothing is done, the public debt will reach its highest level since the end of the Second World War by 2030. Unsustainable!” Almost like Bruno Le Maire or Pierre Moscovici in the text.

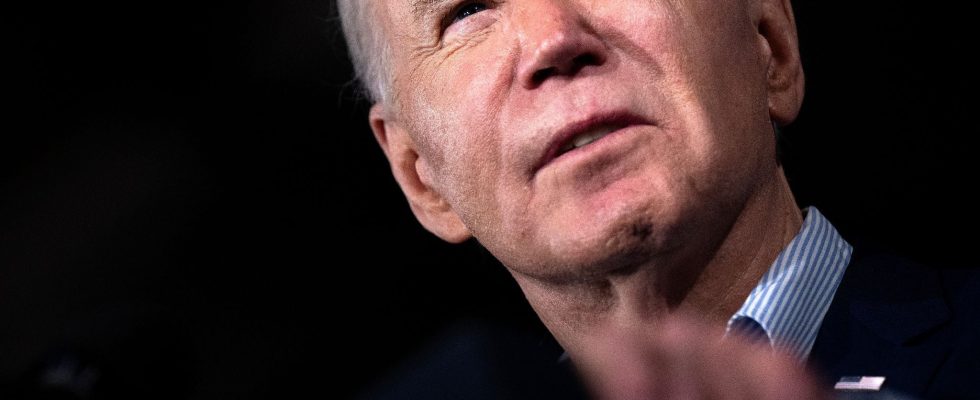

Phillip Swagel, the president of the CBO and the author of these lines, is far from being a novice on the subject. This former Undersecretary of State for the Treasury under George W. Bush – a sort of Minister of the Budget – and professor of economics at the University of Maryland, is a big name in public finances. The situation alarms him. The public accounts deficit rose further to 6.2% of GDP in 2023 and it should never fall below 6% over the next ten years, according to CBO forecasts… The public debt, it, which is already close to 97% of GDP, would rise to almost 106% by the end of the decade, its highest level since 1945. A drift which is due to the gigantic public spending plans put in place by Joe Biden for three years, but also to the very generous tax cuts granted by his predecessor Donald Trump.

If Swagel – a pure Republican – comes out of the woodwork today, it is to denounce the new tax gifts promised by Trump if he regains his seat in the White House in November. The optimists – or the naive – will always be able to assert that no one on the planet really has an interest in triggering a dollar crisis. Not even China, a large part of whose foreign currency reserves are made up of greenbacks and whose value in the event of a crisis could melt. And yet, the strength of the dollar is not an exact science, nor an undeniable fact. It’s all about trust. As in France, we are also waiting across the Atlantic for the verdict of the rating agencies. Last November, Moody’s left its outlook unchanged while stating that the US outlook was now negative. A financial storm starting in the United States and hitting European shores would remind us of turbulent days. After all, 2008 isn’t that long ago!