There will ultimately be no reform of the High Financial Stability Council (HCSF). This proposal, aimed at modifying the functioning of this body to facilitate the granting of real estate loans to households, was withdrawn, this Monday, April 29, by its author, the Renaissance deputy Lionel Causse, during its examination in the Assembly.

After several hours of debate in the hemicycle, the elected official considered that amendments adopted in the evening had distorted his bill too much, at first reading. “I ask for the withdrawal of this text which no longer has any meaning and no reason to exist,” declared the elected Macronist. Supported by Bercy, but criticized by the Banque de France as by the European Central Bank (ECB), the text was put on the table to deal with the worrying drop in the production of new home loans of 40% in 2023 . A rate at the lowest since 2015.

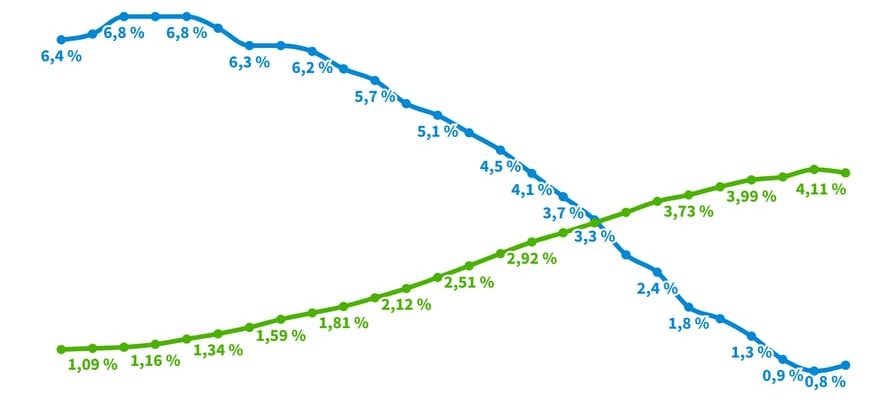

In particular, the cost of real estate loans, which however fell below 4% in the first quarter of 2024, and to 3.99%, according to data from the CSA/Crédit Logement Observatory published in mid-April.

Housing interest rates fell from 4.17% on average in January to 4.11% in February, a first drop in two years.

© / The Express

“Organization too complex”

Created in 2013 by drawing lessons from the financial crisis of 2008 to 2011, the HCSF has established over the years a set of recommendations on real estate credit, always with the objective of limiting household over-indebtedness. But then, what did this bill contain to attract so much criticism and amendments?

The first article of the initial bill added two members to the High Financial Stability Council which currently has eight, one from the Senate and the other from the Assembly, equally. The presence of parliamentarians would contribute “to strengthening the democratic legitimacy of the measures taken”, argued its author Lionel Causse, refuting a threat to the independence of the HCSF vis-à-vis political power. A fear expressed by the Socialists as well as the ECB, in an opinion published last Friday. Finally, the presidential majority voted against this article, unhappy with the adoption of amendments from France Insoumise (LFI), and denouncing alterations creating an “overly complex organization”.

In addition, the other flagship measure of the text, already reworked in committee, was again in session on Monday. In its initial version, it offered the possibility of deviating from HCSF standards in terms of credit granting conditions, but it had been rewritten to maintain the “effectiveness of the powers” of the High Council. By providing that the latter could “set the conditions” in which credit establishments “can deviate from its decisions”.

“Dangerous response”

But the adoption of amendments, emanating from opposition deputies as well as from the majority and supported by the government, constituted the modification too many in the eyes of Lionel Causse. For the socialist Philippe Brun, this text was “an imperfect, insufficient and perhaps dangerous response to a real problem, that of the lack of housing production in our country”. “We will not solve the housing crisis by pushing households into ever more debt,” also criticized the communist Nicolas Sansu.

The governor of the Bank of France, François Villeroy de Galhau, expressed his opposition to the initial reform in mid-March, emphasizing that the banks were not making full use of the flexibility already permitted. The National Rally had announced that it would vote for the text, because of its stated objective. “But for reasons of simplification and for reasons of principle, we are calling for the elimination” of the HCSF, said RN deputy Jocelyn Dessigny.