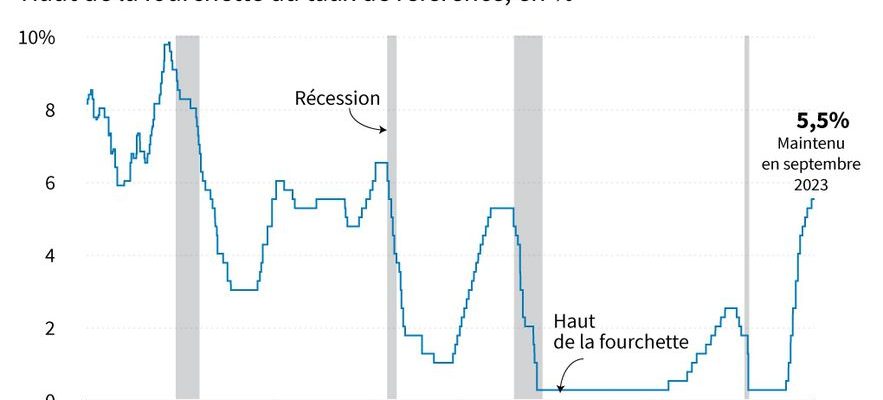

She decided not to change strategy. The American central bank (Fed) left its rates unchanged on Wednesday, November 1, in the range of 5.25% to 5.50%, for the second time in a row, highlighting the strength of the economy, but still ” very attentive” to the risks of inflation.

This is the third time, in the last four meetings, that the Fed has not touched its rates. She wants to avoid slowing down economic activity too much, so as not to cause a recession.

Ease pressure on prices

The main key rate thus remains at its highest level in more than 20 years. This makes credit more expensive for households and businesses, in the hope of slowing consumption and investment, to ease pressure on prices.

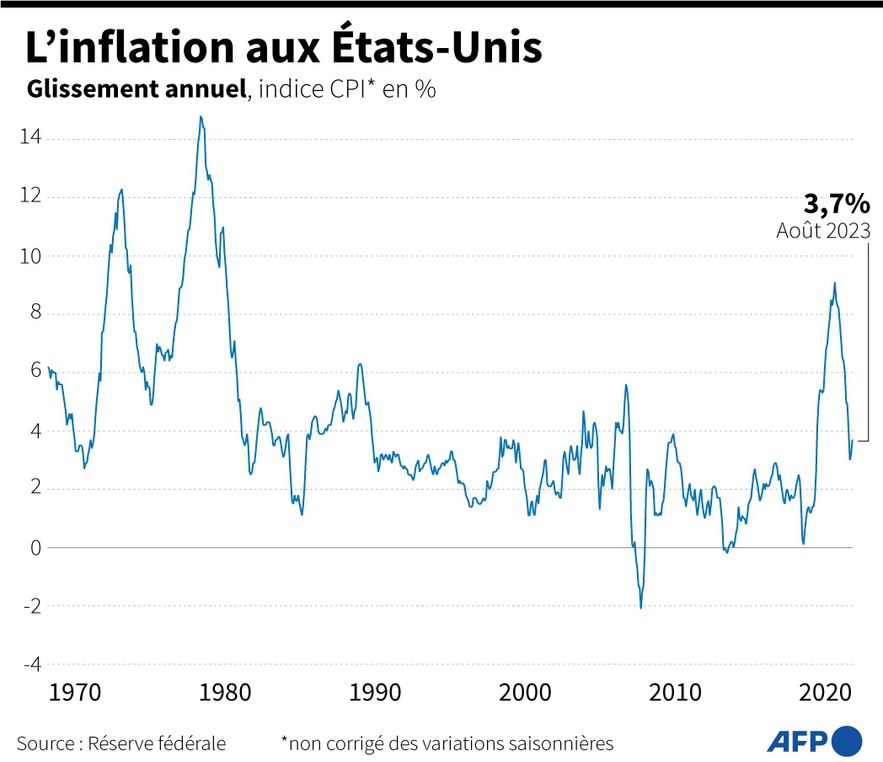

Inflation, the Federal Reserve’s number one fight, “remains well above” the 2.0% target, and bringing it back on track sustainably will take time, warned its president Jerome Powell during a conference. press release on Wednesday, following the meeting. It stabilized at 3.4% at an annualized rate in September, according to the PCE index, favored by the Fed.

Fed key rates

© / afp.com/Jonathan WALTER, Samuel BARBOSA

Jerome Powell did not rule out the possibility of an additional increase at the next meeting, indicating however that no decision had been made at this stage. But “the full effects” of the 11 rate increases carried out since March 2022 “must still be felt”, which may take a long time, he stressed.

Unemployment remains low

Especially since the rise in long-term bond rates, if it is “persistent, may have implications for the monetary policy” of the Fed, he warned. Wall Street ended sharply higher on Wednesday, after this status quo on rates. Jerome Powell “tried to leave an option (on a rate hike) but it did not seem very convincing”, underlined Edward Moya, analyst at Oanda. “It is clear that the Fed does not know when we will feel the full impact of its tightening cycle,” he added.

The president of the Fed, on the other hand, assured that the institution, at this stage, is not thinking “at all” of lowering its rates. The American economy, in fact, is much more vigorous than expected, he further noted. Growth soared in the third quarter, doubling to reach 4.9% at an annual rate.

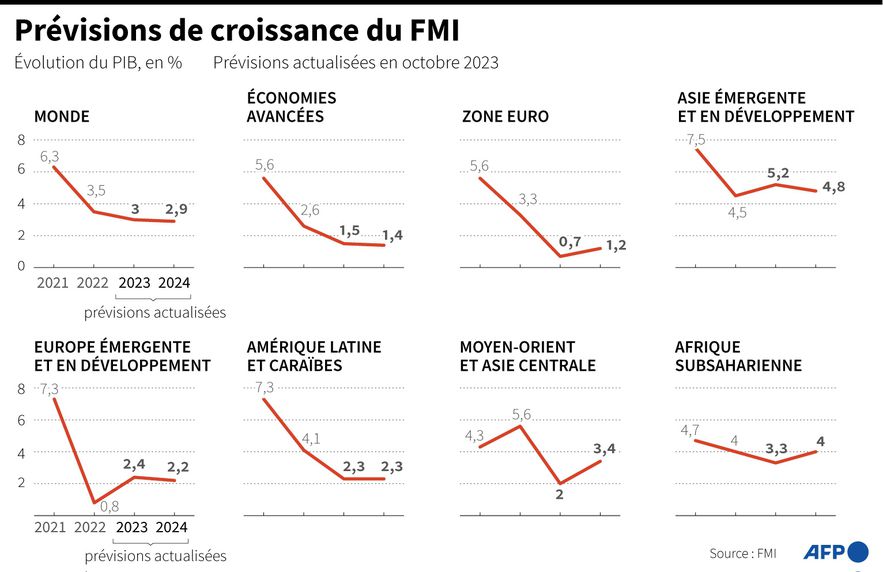

IMF growth forecast

© / afp.com/Maxence D’AVERSA

At the same time, unemployment remains low, at 3.8% in September, with the persistence of a lack of labor in various key sectors. October figures will be released on Friday. The labor market, which has been facing a significant labor shortage for more than two years, has recently seen an influx of new workers, “both due to the (increase in) participation in the labor market and immigration,” detailed Jerome Powell.

This contribution of labor represents “a significant gain”, and “really helps the economy. This partly explains why the GDP (gross domestic product editor’s note) is so high”, he added.

Clouds

But, although the American economy appears more solid than ever, even though it was expected to be in a slight recession at the start of the year, clouds are gathering on the horizon, both nationally and globally. The war between Israel and Hamas, which began on October 7, could indeed lead to a rise in oil prices, especially if it were to spread to other countries in the region.

Inflation in the United States

© / afp.com/Jonathan WALTER, Laurence SAUBADU

The World Bank estimated on Monday that in the event of widespread conflict in the Middle East, the price of oil could exceed $155, an unprecedented level. Such a rise in energy prices would immediately cause raw material prices to rise, with the ultimate risk of causing inflation to start again.

And at the national level, in the United States, the election of a “speaker” to the House of Representatives, Mike Johnson, after three weeks of procrastination within the Republican Party, makes it possible to consider a vote on the federal budget for 2024.

But it is a safe bet that the standoff between Republicans and Democrats will start again, while the public deficit soars. There are only two weeks left to reach an agreement, and avoid a paralysis of the federal state.