While new real estate is popular for the low maintenance it requires, investors generally turn away from it due to lower rental profitability. Indeed, for similar rents, new properties traditionally suffer from much higher purchase prices, which degrade the financial interest of the operation. However, this observation seems to be reversed in certain cities in France, according to a study carried out by the turnkey investment company Maslow for L’Express.

“We have noticed, in a dozen cities in particular, that if we take into account the average renovation costs of an old home, it is now cheaper to buy a new apartment,” explains Pierre-Emmanuel Jus, Maslow’s deputy director. To arrive at this conclusion, the platform is counting on an average cost of 1,250 euros per square meter in order to bring the property up to date and better insulate it.

A scissor effect is currently taking place, particularly favorable to buyers of new properties. In some cities such as Noisy-le-Grand, Aubervilliers, Bordeaux, La Rochelle, Bayonne, or Montreuil, the prices of old properties have increased significantly over the past ten years, for various reasons: arrival of the RER, increased appeal of the coastline after the health crisis, gentrification of certain neighborhoods. At the same time, in these same municipalities, the prices of new programs are experiencing a historic decline. “The prices displayed remain stable but many commercial offers are proposed to complete the sales of buildings whose construction was launched before the real estate crisis we are going through”, explains Pierre-Emmanuel Jus.

Promoters in a hurry

Result? Investors can easily obtain an additional room or significant discounts: most often in the order of 6 to 7%, but up to 12% for the best negotiators. Not to mention that new real estate benefits from structurally lower notary fees – 2 to 3% compared to 7 to 8% for old properties – when they are not offered by developers eager to complete their operation as quickly as possible! “Professionals have suffered between 40 and 50% cancellations on reservations. There are also returns to sales, due to the lack of financing validated by the bank, relates Pierre-Emmanuel Jus. However, if they do not sell to individuals, their alternative is to turn to the Caisse des Dépôts et Consignations, with a 20% discount!”

Conversely, the old one bears the burden of renovation work, which has increased significantly over the past two years, both in terms of costs and deadlines. This item is not expected to ease in the coming years due to the increasingly heavy constraints weighing on landlords in terms of thermal insulation.

One drawback: the distance from city centres

In fact, a change of model is taking place: cheaper to buy, requiring less maintenance and allowing better loyalty of tenants now sensitive to heating costs, new construction is taking the lead. The only downside: these programs are mainly developing in areas outside city centers, but which often benefit from ambitious urban planning policies bringing services and public transport. This is the case of the first city in our ranking, Meyzieu (Rhône), now connected to Lyon by tramway, close to the Grand Large nautical base and which is not subject to rent controls.

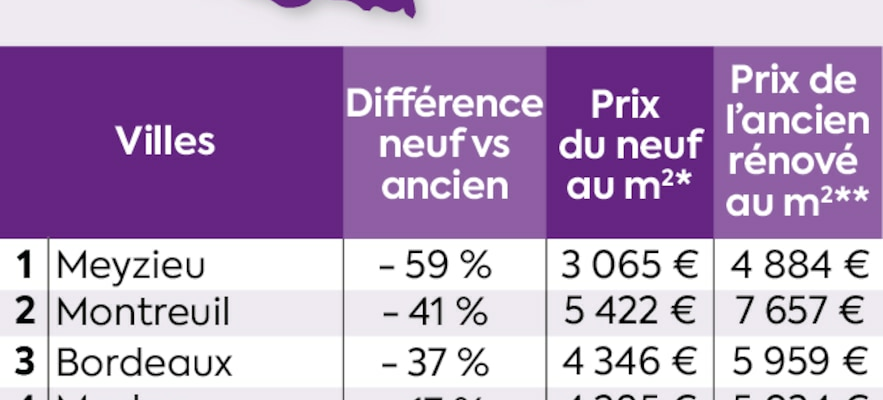

These cities where new is advantageous.

© / The Express

“When new is a little more expensive than old, up to 10%, the gain in terms of rental period, management time, tenant loyalty and development potential of the area remains very favorable,” concludes Pierre-Emmanuel Jus. According to the latter’s calculations, betting on new is always attractive in Nantes, Créteil, Toulouse, Besançon, Nice and Lyon, even if the price is slightly higher than that of old. If you are interested in the approach, look for programs that must be completed quickly. Don’t limit yourself to the punchy offers already proposed by developers. And don’t hesitate to negotiate until the end: the period lends itself to it.

.