Don’t put all your eggs in one basket: let the one who has never heard his advisor repeat this maxim cast the first stone! It is true that diversification is a key concept in wealth management. “The goal is to reduce the risk of losing money by spreading your assets across several asset classes,” summarizes Romain Mahieu, director of discretionary management and solutions at Richelieu Gestion. The concept is established. It has even been widely theorized, notably by the American economist Harry Markowitz, famous for his modern portfolio theory, based on diversification. “The idea is the following: if you have two assets, one of which performs better than the other, you improve the risk-return profile of your portfolio by combining them,” explains Nadine Trémollières, director of Primonial Portfolio Solutions.

At first glance, this may seem absurd. Why not bet everything on the most effective investment? First of all, because in practice, it is not always easy to identify it. For example, there is no surefire way to know which stock will top the indices in the coming years. For example, few investors have benefited from Nvidia’s spectacular rise (+2,950%) over the last five years. In addition, it is often difficult to accept the risk associated with the best-performing vehicles, symbolised on the financial markets by the volatility of stock prices. For example, the American technology index, the Nasdaq 100, one of the best-performing indices in recent years (+164% in five years) could have lost up to 30% in the space of a week! “It all depends on your profile, but most clients cannot tolerate these downward movements,” notes Nadine Trémollières. Which sometimes leads them to make bad decisions at the worst times.

Diversification is therefore a more subtle art than it seems at first glance: it is not enough to pile up shares, funds and other various products to correctly compose one’s assets. “To reduce risks, we seek above all decorrelation, explains Meyer Azogui, president of the Cyrus group. Because not all assets react in the same way depending on the context, except in an extreme crisis.” Thus, financial theory dictates that shares and bonds react differently for a given interest rate environment. But during a major crash, all assets tend to move in the same direction, irrationally, before balances are reestablished. “Private equity [NDLR : entreprises non cotées] and structured products also provide decorrelation, underlines Romain Mahieu. The latter offer, for example, a performance capped in relation to the stock market, but also safeguards in the event of a decline.”

Another difficulty: these balances are shifting and must be regularly checked according to financial cycles. “We saw this last year with gold,” says Nadine Trémollières. “The metal rose when rates increased, which is not logical from the point of view of financial orthodoxy.” For this reason, there are no rules set in stone. “The target strategic allocations that we put in place for our clients evolve over time: we update them regularly according to the latter’s life events as well as the economic and stock market situation,” relates Meyer Azogui.

Accept a lower gain for a given time

Also beware of false diversifications, which are particularly frequent. Thus, many savers are overexposed to our domestic economy, with a bias in favor of investments in the French market. “The tax measures in force, such as the stock savings plan, direct capital towards French and European companies while the growth differential with the United States calls for a better internationalization of contracts,” suggests Nadine Trémollières. The same is true from a sectoral point of view: multiplying investments while remaining focused on luxury or technology only provides a superficial diversification. “We are often asked by our clients about stocks linked to artificial intelligence, because these are experiencing phenomenal growth, notes Romain Mahieu. It may be tempting to significantly increase the share devoted to this area, but there are many other stocks, sectors and markets that also offer opportunities.” Protecting yourself against a sudden market reversal in this case means accepting a lower gain for a given period of time.

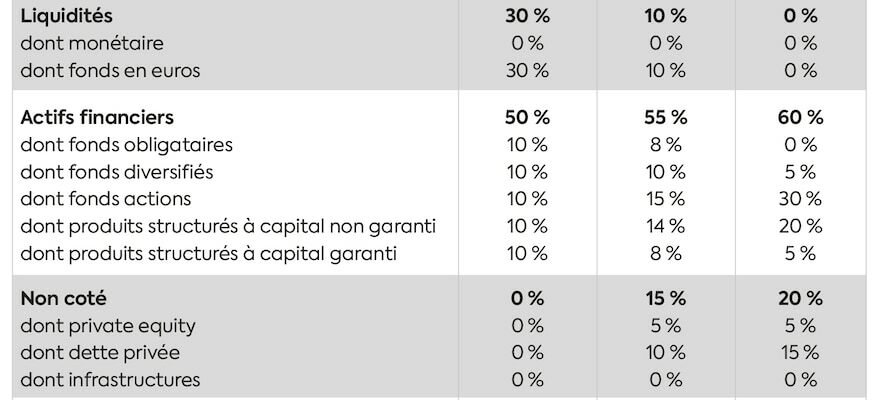

3820CT INVESTMENTS typical allocations

© / The Express

Should this serenity come at the expense of convictions? These two dimensions are not contradictory, professionals assure. It’s all a question of balance. “We must not confuse diversification and dispersion, because it takes time, generates additional costs and reduces readability, points out Meyer Azogui. We must adjust according to the size of the assets.” On the stock market, the famous investor Warren Buffet recommends, for example, limiting yourself to around fifteen stocks, in order to know them perfectly. “Holding 50 stocks is useless, agrees Nadine Trémollières. It is not relevant to have lines whose weight is less than 5% of your portfolio.”

As for exploring more exotic horizons, such as gold, unlisted assets, art or other, everything depends on one’s personal wealth. According to Meyer Azogui, the basis of one’s assets must be composed of a few fundamental elements: precautionary savings and principal residence essentially. Then come investments intended to finance the current or future lifestyle, such as rental property, a bond portfolio or even life insurance in which it is possible to make redemptions.

It is only once this base has been established that it will be possible to venture into other types of investments. But be careful: the more you go into original asset classes, the less you will be in controlled territory. Be wary of products with overly good promises and unknown players! Some sectors particularly attract scammers, such as forex (the currency market), crypto-assets or even real assets (wines, livestock, etc.). If the intermediary who is contacting you is not your usual advisor, check their accreditations on the official websites of the Prudential Supervision and Resolution Authority and the Financial Markets Authority. Finally, for any complex product, ask for documentation, and read it quietly at home before subscribing.

An article from the special report “The best investments for the start of the school year”, published in L’Express on September 19.

.