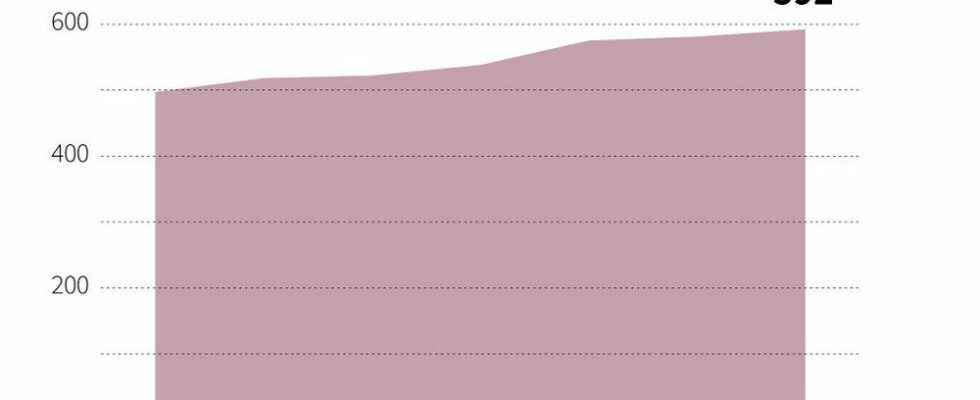

The arms trade is still going strong. According to the report of the Stockholm International Peace Research Institute (SIPRI) published this Monday, December 5, the 100 largest arms companies – for which SIPRI can access enough data – sold arms and services intended for the military sector for a total of 592 billion dollars (about 562 billion euros). euros) in 2021, an increase of 1.9% compared to 2020.

This growth, however, was severely impacted by widespread supply chain issues. “The lasting impact of the Covid-19 pandemic is really starting to show in arms companies,” Nan Tian, a researcher at SIPRI and co-author of the report, told AFP. Problems in terms of labor shortages and the supply of raw materials have “slowed down the ability of companies to produce weapons systems and deliver them on time”.

The 100 largest arms companies sold weapons and services for the military sector for a total of 592 billion dollars (about 562 billion euros) in 2021, up 1.9% compared to 2020.

Sophie RAMIS, Nalini LEPETIT-CHELLA / AFP

“What you’re really seeing is possibly slower growth than many had expected in arms sales in 2021,” he said. “We could have expected even greater growth in arms sales in 2021 had it not been for the persistent supply chain issues,” says Dr. Lucie Béraud-Sudreau, director of the military expenditure and production program. armaments of SIPRI, quoted in the press release.

“Increasing production takes time”

Supply problems are expected to worsen with the war in Ukraine, in particular “because Russia is a major supplier of raw materials used in the production of weapons”, according to the authors of the report, but also because this conflict has led to an increase in demand.

This could hamper ongoing efforts in the United States and Europe to bolster their armed forces and replenish their stockpiles after sending billions of dollars worth of ammunition and other equipment to Ukraine.

“Increasing production takes time,” said Dr. Diego Lopes da Silva, senior researcher at SIPRI, quoted in the SIPRI press release. “If supply chain disruptions continue, it may take several major arms producers several years to meet the new demand created by the war in Ukraine.”

Private investment companies that buy arms companies

Although American companies still dominate the global arms production market, accounting for more than half of global sales (or $299 billion), the United States is the only region in the world to have seen a drop in its sales compared to 2020. Of the five biggest companies in the market – Lockheed Martin, Raytheon Technologies, Boeing, Northrop Grumman and General Dynamics – only Raytheon saw its sales grow. Meanwhile, sales of China’s eight largest arms companies soared 6.3% in 2021 to $109 billion.

European companies, which now make up 27 of the top 100 companies, total $123 billion in revenue, up 4.2% from 2020. As the SIPRI report notes, French group Dassault Aviation’s arms sales surged 59% to $6.3 billion in 2021, thanks to deliveries of a total of 25 Rafale fighter jets.

The United States is the only region in the world to see a decline in sales compared to 2020. Meanwhile, sales of the eight largest Chinese arms companies rose 6.3% in 2021, to $109 billion.

SOPHIE RAMIS, NALINI LEPETIT-CHELLA / AFP

The report also notes a trend among private equity firms to buy arms companies, a development the report’s authors believe has been more visible in the past three or four years. According to them, this trend threatens to make the arms industry more opaque and therefore more difficult to trace. “Because these private investment companies will buy these companies and practically no longer produce public financial data,” explains Nan Tian.