(Finance) – Brilliant upside for Whirlpoolwhich rises dramatically, with a gain of 5.09%.

The appliance giant reported first quarter results showing net earnings declining from 433 million, or $ 6.81 per share, to 313 million ($ 5.33). In the three months, the Michigan group recorded an adjusted EPS of $ 5.31 higher than the $ 4.79 expected by the consensus. Sales fell from 5.36 to 4.92 billion compared to 5.30 billion for analysts.

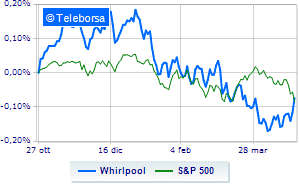

Comparing the performance of the stock with theS & P-500on a weekly basis, we note that Whirlpool maintains positive relative strength in comparison with the index, demonstrating greater appreciation by investors compared to the index itself (weekly performance + 10.07%, compared to -4.29% of theUS basketball index).

The medium-term situation of Whirlpool remains broadly bearish. However, looking at the short chart, it would be fair to start doubting whether the bearish phase can extend. An upward improvement of the curve that meets the first obstacle at USD 193.8 is therefore expected. Support seen at 183.2. Further bullish ideas favor a new target probably estimated in the 204.4 area.