Where does the money come from? Where does it go? Investment flows in tech are being scrutinized ever more closely by the United States. After restricting the ability of the Chinese to invest in its technological nuggets, Washington is going to limit the ability of Americans to invest in Chinese companies. The idea is not to “finance its rival” explains Mathilde Velliet, researcher at the Geopolitical Center for Technology at the French Institute of International Relations (Ifri), who is publishing tomorrow, July 3, a study on the subject that she reveals exclusively to L’Express.

L’Express: Have the United States tightened its rules on investments coming from or going to China?

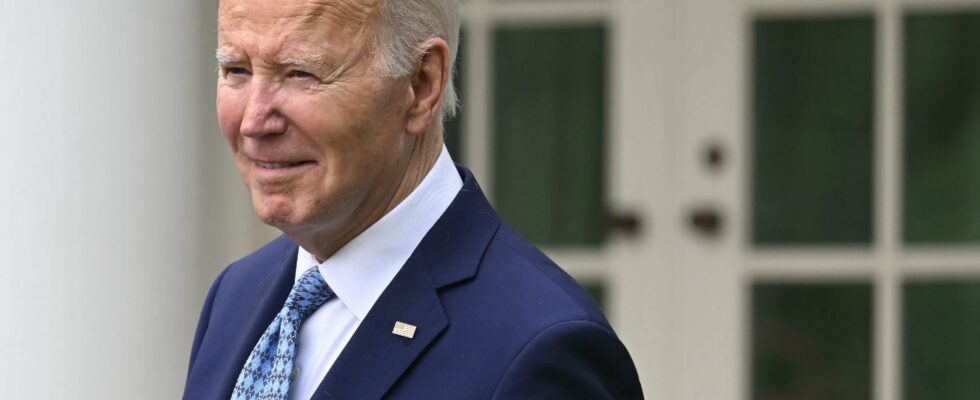

Mathilde Velliet: The idea of not encouraging the capabilities of a potential adversary emerged in the 1980s. But the issue only really gained prominence in the 2010s, when Chinese players began investing in or acquiring more or less strategic American companies. Regulations on inbound investment became clearer under the Trump administration. But it is only in the last two years that outbound investment, that of the United States in China, has become a subject of concern, included in the political agenda of Congress and the executive branch. An executive order signed by Joe Biden last August targets American investments in three sectors in particular: artificial intelligence, semiconductors and quantum. The aim of this order is to require that they be notified to the authorities in the future. In some cases, they will even be prohibited. This regulation will be implemented during the course of the year. And the United States is encouraging the Europeans to look into the subject.

Is the tech sector the only one affected by these restrictions?

They are indeed about technology in the broad sense. The aim is to target all American investments likely to strengthen Chinese capabilities in cybersecurity, intelligence and military action.

Why does the United States consider investing in Chinese tech more problematic than in companies from other countries? Their allies are also likely to create competitors for their technology champions.

China is not just an economic and technological competitor to the United States, it is a strategic rival. That is the game changer here. Washington is concerned that China is threatening its technological supremacy, because that is the foundation of its military supremacy.

The share of US and European investment in Chinese tech is limited. Why is this considered a concern?

Indeed, three-quarters of investments in the Chinese technology sector come from Chinese players – investors, large companies, public institutions. Americans and Europeans are present in only 12% of financing rounds.

Washington, however, fears that investments – even limited ones – will finance Chinese military capabilities. The paradox, which American politicians denounced, is that the United States restricted exports to certain Chinese companies but until now authorized investments in them. This amounted to prohibiting American companies from selling them products, but also giving China the money to develop its own capabilities. Behind these transactions, there are also intangible benefits such as access to the networks of American investors. Hence the idea of not only prohibiting exports but also American investments in certain Chinese technologies.

Among the American and European investments that you analyzed, which were potentially problematic?

A fairly limited number. On the European side, there was an investment in Chinese quantum, a sphere closely linked to the military, and one in a Chinese foundry (SJ Semi) blacklisted by the United States because of its contribution to the modernization of the Chinese army. Among the top ten American investors in China, seven have invested in companies currently under sanctions. Often, these investments were made before the companies were listed, but it was already known to everyone that they were linked to the Chinese military or surveillance ecosystem. But in several cases, these investments took place after the companies were listed under sanctions. There are significant links between American investors and certain Chinese companies closely linked to the military and surveillance.

Does the EU have the same approach as the United States on this subject?

The European Union, encouraged in this by the United States, is considering the relevance of implementing new tools to control outgoing investments towards China. And it is aware of the lack of precise information on the subject.

You point out the opacity surrounding Western investments in China. At what levels is it located?

Less and less data is being made public on databases such as Crunchbase. In 4% of cases, the name of the investor is not disclosed, and in more than 50% of cases, the amount is not disclosed. The creation of intermediary structures further complicates the mapping of these transactions. Many structures are headquartered in China but were, in fact, created to manage American funds. This is why the United States wants to impose that this information be, at a minimum, provided to the Treasury.

And what is China’s policy on the subject? Like the Americans, does it not view with suspicion the investments that its “rivals” make in its technological nuggets?

Some observers point out an inconsistency in the discourse. If Chinese investments in American companies are considered a vulnerability for the United States, shouldn’t Americans try as much as possible to be present on the boards of Chinese companies? The debate on the subject is lively. (laughs). China, for its part, finds itself returned to its paradoxes. The authorities denounce an American desire to slow down the technological development of the country.

But since the Chinese market itself is not open to investment without restrictions, Beijing cannot cry foul either. This is the country’s great dilemma: given the current Chinese economic context, foreign capital would be useful to them. But there is a strong desire for control, particularly in strategic sectors. And historically, there is a desire for autonomy in strategic technologies. This has been a clear priority since Deng Xiaoping, and it has been even more so since Xi Jinping. Huge public or semi-public investment funds have, for example, been created to develop the semiconductor sector – as illustrated again by the announcement last May of a new fund of nearly 45 billion dollars for this sector.

“Financing your rival. When the United States and Europe invest in Chinese tech”, by Mathilde Velliet, Études de l’Ifri, July 2024.

.