With rising interest rates, solid returns in 2023, and a very promising start to 2024, the sky is clearing for savers. A flexible tool with preferential taxation, life insurance is once again becoming attractive and the safest of banking investments. However, in a context of inflation, diversification remains the wisest course. Identify your needs, identify the different products available, negotiate your contract, go through a management company, monitor costs, generate long-term performance: L’Express guides you.

46 million: this is the number of life insurance policies held by French households, according to data from France Assureurs. What are they worth? Impossible to say, as this market is full of different products launched over the years, most of which are no longer marketed today, and some are even closed to any new payments. Behind the curtain, the company archives are dizzying, with hundreds of lines of contracts for the oldest brands. In this maquis, it is up to each saver to determine whether their life insurance, sometimes taken out several decades ago, remains competitive. How to know? Based on the performance of its fund in euros, its financial offering, fees charged and associated services. If you are satisfied, keep it safe. On the other hand, what to do in the event of a negative balance sheet? On paper, you have two solutions: keeping the contract or closing it permanently. Make the match!

Why keep a (bad) contract

Many savers cling to their dying contracts so as not to lose the tax advantages. A fair observation but one which should not be given more importance than necessary. Everything will depend on your needs and the age of your life insurance. If you plan to draw on it shortly (in the next five years), it remains fiscally interesting to do so in an envelope more than eight years old rather than reinvesting in a new one, even of better quality. Because you benefit from the annual reduction on interest (4,600 euros for a single person, 9,200 euros for a couple), often allowing you to avoid being taxed. But, if your intention to make withdrawals is more distant in time or downright uncertain, this reasoning falls apart.

What about in the event of death? Two pieces of information are decisive here to take a position: the date you took out the contract and your current age. If you opened it before October 13, 1998, you will undoubtedly have an interest in keeping it, whatever its quality: the tax rule was then more advantageous since everything that was paid before your 70th birthday and the aforementioned date is will pass on tax-free, as will the winnings. It’s up to you to see if the amounts involved are significant, because if you have paid little before this deadline, the tax advantage will remain minimal. Let us add that, for contracts subscribed and funded before November 20, 1991, everything paid into it (even after 70 years) before October 13, 1998 is exempt on death, the remainder benefiting from the reduction of 152,500 euros per beneficiary. These very old envelopes must be carefully preserved for the purpose of transmission. To study calmly.

For contracts taken out after this date, the taxation remains the same until today. There would therefore be no contraindication on this point to changing it, but don’t forget another element, your age. Are you under or over 70? Beyond that, reinvesting would be unfavorable to the beneficiaries, since the capital paid (not the interest generated) will then be subject to inheritance tax depending on the relationship between the insured and the beneficiaries after an overall reduction of 30,500 euros (which regardless of the number of beneficiaries). Whereas, before age 70, each beneficiary benefits from a reduction of 152,500 euros on the capital received. There remains one important point: if your spouse or civil partner is designated beneficiary in the event of death, he or she will be exempt from duties to pay, regardless of your age at the time of payments.

Although important, taxation should not be a pretext for inaction. Moreover, there is an alternative to maintain the tax precedence of your contract while changing the frame: its transfer. This is authorized provided you stay with the same insurer. Interesting ? Yes, if the receptacle offered offers good value for money. You must act with discernment and, of course, have real motivation for the transfer. Companies are pushing in this direction (988,000 transfers were recorded between 2020 and 2022), sometimes with investment constraints on risky funds or fees taken along the way. Is it in your interest? Be careful on another point: some old life insurance policies include a guaranteed minimum return of 4.5%, or even more, on the euro fund. In such a case, you might as well keep them, at least as long as the current euro funds do not yield more.

Why and how to look elsewhere

If your life insurance is unremarkable with, for example, a poor return on the fund in euros (less than 2% in 2023), recover all of your capital to reinvest it in a good contract. To consider without delay if you do not need to recover your capital in the short or medium term, if you have not passed the 70-year mark, or if your envelope does not benefit from a high guaranteed rate of return (quite rare). In practice, closing a life insurance policy amounts to carrying out a total redemption, an operation requested from your insurer by registered letter with acknowledgment of receipt, specifying the contract number, proving your identity and providing a RIB. Once the file is completed, the insurer has thirty days at most to pay you.

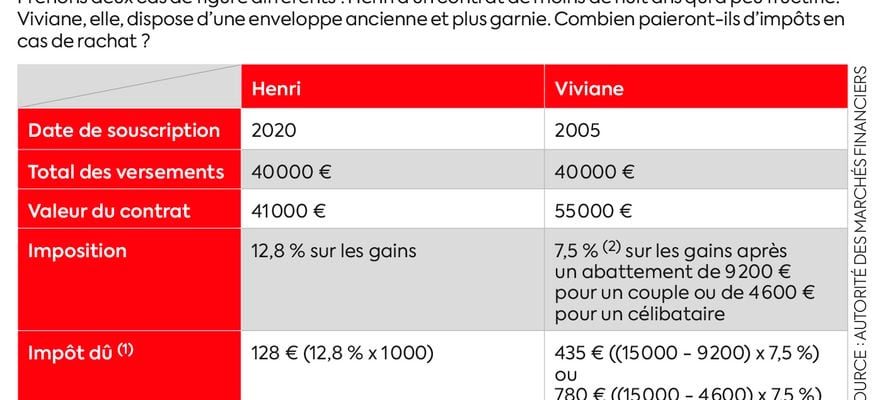

So much for the modus operandi. Please note that you can make this purchase even if your product is less than eight years old. With what tax impact? It all depends on its seniority, more or less than eight years, and the date of the payments (before or after September 27, 2017). But, even for a recent contract, the bill will not be as steep as anticipated (see infographic). And for good reason, the taxation only concerns the gains included in the amount withdrawn, not the total amount extracted, since the latter includes a capital portion. In addition, if you do not pay income tax or at a very low rate, integrating taxable interest into your taxable income for taxation at the progressive scale will remain preferable to suffering the flat rate deduction of 12.8%. Please note, this decision concerns all of your investments eligible for the flat-rate deduction (booklets, securities, etc.).

Withdrawals at a moderate tax rate

© / The Express

Closing your life insurance torments you? There is a less radical approach. This investment has an advantage over a number of investments (PEA, regulated savings accounts, PEL, etc.), you can hold as many as you want. Nothing prevents you from signing up for one or two good contracts today, in order to set a date to keep the tax meter ticking. The strategy then consists of separating you from your old life insurance gradually to optimize the tax rules on withdrawals. One condition, however, is that she is at least eight years old. Explanation: the tax rate on the interest included in a withdrawal is then 7.5%, after a significant annual reduction on the interest included in the withdrawals (4,600 euros for a single person, 9,200 euros if they live as a couple ).

If you have a significant amount, spread your departure over several calendar years to use the reduction several times and avoid going through the tax box (excluding social security contributions, which are inevitable). You will thus gradually move your savings to the new envelope and will be able to close the old one once all outstanding assets have been protected. To the wise…

An article from the special Placements section of L’Express, published in the weekly on April 11.

.