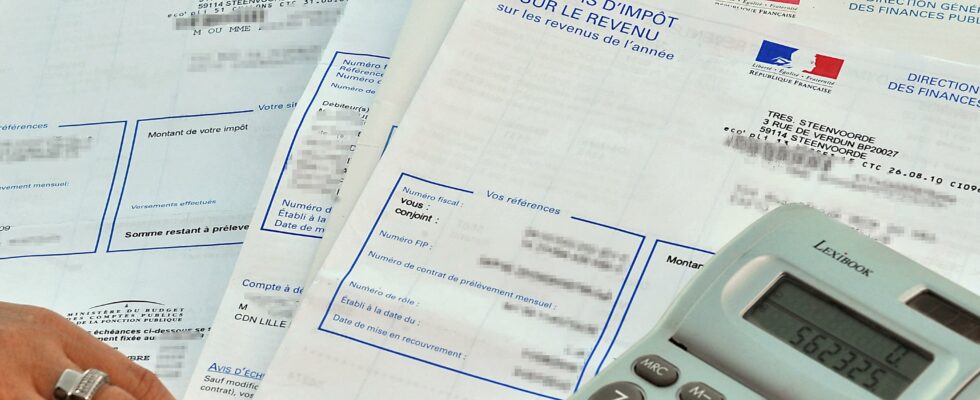

With summer holidays looming and the start of the school year not yet in sight, now is a good time to look at your tax notice. These forms are made available between the end of July and the beginning of August for the digital version, and until August 29 at the latest for taxpayers using paper.

Since 2019, the administration has introduced a right to make mistakes, which allows you to regularize your errors or omissions. An online correction service is also active on your personal space and will be accessible until December 4. However, it is reserved for those who have declared online. For others, you must make a complaint, via the site’s messaging, by telephone or by going to the public finance center to which you are attached.

Avoid or limit sanctions

Forgotten income, incorrectly checked box for a tax reduction, inaccurate property valuation… Many elements can be changed. The interest? Avoid or limit sanctions. Indeed, in the event of an error, you incur an increase in the tax due as well as late payment interest. Spontaneous rectification makes it possible to avoid the first and limit the second.

Please note that the right to make mistakes does not authorize you to file your tax return after the deadline, to pay your tax late or to deliberately lie. Moreover, the leniency of the administration disappears in the event of a repeat offense… Furthermore, certain information cannot be modified. This is the case for information relating to your civil status or family situation.