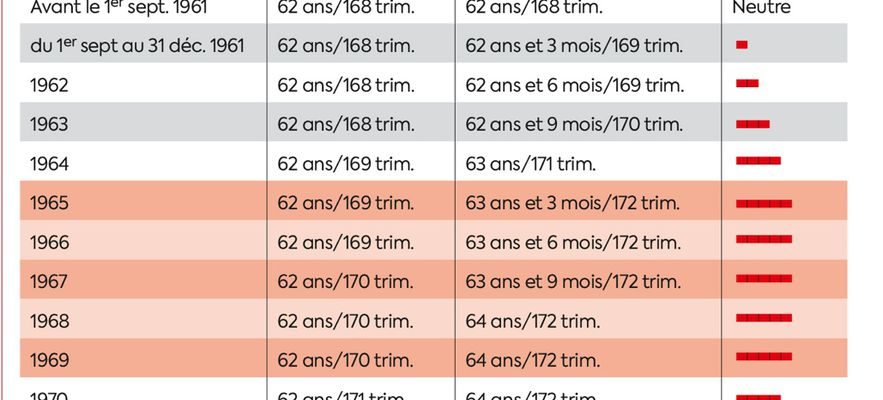

It is therefore 64 years, the new minimum legal age for retirement, versus 62 years previously. This is the key element of the law passed in the spring, which also provides – it is less known – an increase in the number of quarters required to obtain a full-rate pension. And its deployment is progressing well, with the publication of the implementing decrees! “Unlike past reforms, this one provides for immediate application of the measures,” notes Marilyn Vilardebo, president and founder of the company Origami & Co, a company expert in retirement auditing. For people born since September 1, 1961, who undoubtedly had planned their departure, the difference in age and duration of insurance makes it necessary to review the strategies put in place.”

Everyone is affected, unless you were born before September 1961. If you are lost, you can refer to the official simulator: la-reforme-des-retraites-et-moi.fr. Also keep the following two guidelines in mind. First: the 64-year limit will apply to all generations born from 1968. Second: it will take 172 validated quarters (i.e. 43 years) to receive a full-rate pension from the 1965 generation. For the record, it was necessary 150 (37.5 annuities) in 1982…

These two measures change the temporal situation: we now have to leave later and work longer. They also modify the amount received. By working longer, your retirement will de facto be higher thanks to the additional points acquired in supplementary plans. It is still necessary to receive income subject to contributions, whether it is an activity or compensated inactivity. Otherwise, the pension will not be better, on the contrary, taking into account the penalties imposed on those who do not meet the required number of quarters.

Another, more twisted impact: with the increase in the retirement age, pensions will be paid for a shorter period of time, all things being equal. And for good reason, life expectancy from the age of 65 has been stalling in France for around ten years. According to INSEE, it was 19.3 years for men in 2014, compared to 19.2 years in 2022, and 23.3 years for women, compared to 23.1 years (provisional data).

Four age limits for long careers

Let’s clear up another misunderstanding relating to the minimum perceived. The reform increases its amount to 85% of the net minimum wage, or nearly 1,200 euros gross per month. Except that this is an amount including supplementary pensions and allocated for a complete full-time career at the minimum wage. Translation: this will not be the case for everyone.

Other elements of the law – less controversial – may concern you. The long career system, first of all. From now on, four age limits allow early departure, the earliest being 58 years old, provided you have started working before the age of 16 and validated five quarters before the end of the calendar year you turn 16 (four if you are born at the end of the year). Departures are also possible at 60, 62 and 63, provided again that you have worked five quarters before turning 18, 20 or 21. Please note that quarters purchased for apprenticeship periods carried out between July 1972 and the end of 2013 will be retained to benefit from this system.

Side family, the increase of eight quarters for the birth and education of the child will now be distributed differently, since six of them will be automatically allocated to the mother, compared to four before. The remaining two can benefit the father or the mother depending on the choice of the couple. Another development: parents with at least one child and a complete career at age 63 will benefit from an increase on their basic pension of 1.25% per additional quarter worked up to age 64.

Reform: double punishment for fifty-somethings!

© / DR

The combination of employment and retirement is also being revised. Until now, if you returned to work after leaving your old job, you paid contributions without funds. Now you will get new rights. “It’s a good system provided you have paid your pension at full rate,” confirms Jean-Luc Leca, CEO of Océa Concept. Please note: these bonuses will be capped and you will not be able to return to work with your former employer for six months, a constraint which did not exist before the reform.

Unknown about supplementary diets

Some unknowns remain. Certain implementing decrees are in fact still awaited, in particular on progressive retirement, a system which allows you to reduce your working time at the end of your career while receiving part of your pension. The only certainty: it will be generalized to all plans and the employer will have to justify any refusal. More surprisingly, the reform did not change the automatic age of the full rate, still set at 67 years. Many experts predict that it will quickly be pushed back by two years, to 69 years old.

Above all, “the reform only concerns the basic regime”, notes Marilyn Viladerbo. What will happen to supplementary schemes, in particular that of private sector employees known as Agirc-Arrco? At the helm, the social partners validated at the beginning of October an agreement putting an end to the 10% penalty (called the solidarity coefficient) in force for people leaving at the legal age with every quarter. This removal will take effect on December 1 for new departures, and on April 1, 2024 for current retirees. This key element will reassure current fifty-somethings. As a reminder, the weight of the “additional” part of a pension is between 25 and 75% depending on the situation and particularly concerns executives. Conversely, the agreement provides for a cap on the points acquired in the event of combined employment and retirement, making this system less attractive.

.