A bitcoin for 160,000 euros! This is the recent prediction of American financier Anthony Scaramucci, former banker at Goldman Sachs and founder of the SkyBridge Capital investment fund. An announcement brushed aside by economist Peter Schiff, boss of Euro Pacific Capital. The latter predicts, conversely, that the value of cryptocurrency will eventually collapse and fall… to zero. The debates rage. But one thing is certain: since the start of 2024, the most famous cryptocurrency has left no one indifferent. The logical consequence of a series of events which all contributed to its media coverage.

The arrival with fanfare of ETFs

First act: the launch, on January 11, of 11 index funds – ETFs or exchange-traded funds – devoted to bitcoin, duly approved by the Securities and Exchange Commission (SEC), the watchdog of the American Stock Exchange. These products, whose price automatically follows the evolution of the digital currency, are obliged to hold bitcoins in their portfolio up to the amount of capital they collect from investors.

Long-awaited, since their listing they have experienced strong enthusiasm from investors interested in this financial novelty. A wave of transactions swept through, mainly towards the iShares Bitcoin Trust (Ibit) and Fidelity Wise Origin Bitcoin Fund (FBTC) ETFs, issued by BlackRock and Fidelity respectively. It must be said that these instruments are backed by world-renowned management companies and feature competitive management fees of 0.25% on the amounts placed. These two funds also benefited from arbitrage, in their favor, from savers who held shares in a former bitcoin vehicle, launched in 2013 by Grayscale and now converted into an ETF (Grayscale Bitcoin Trust or GBTC). The latter, holder of nearly 500,000 bitcoins, displays management costs significantly higher than its competitors: 1.5% on the sums invested.

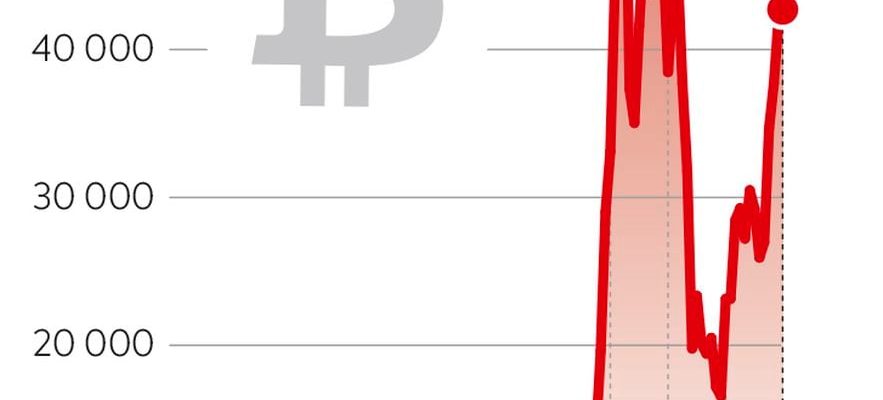

Bitcoin: a spectacular comeback.

© / Art Press

The consequences of halving

The second act, scheduled for next April, sets the cryptosphere in turmoil. THE “halving”, which occurs every four years, is an algorithmic process whose goal is to halve the number of new bitcoins put into circulation. A system which ultimately aims to cap its final production at 21 million entities by the year 2140.

For the record, the operation of the bitcoin blockchain, the digital medium on which the cryptocurrency is based, arises from the “mining” activity. Thus, miners, thanks to ultra-powerful computing machines, decipher, on average every ten minutes, a cryptographic enigma. The resolution of the latter makes it possible to validate a block of data where all the transactions over the period are recorded. A strategic actor ensuring the integrity of the procedure, the miner who solved the enigma receives a reward of 6.25 brand new bitcoins. From April, his remuneration will drop to 3,225 bitcoins. However, these actors resell all or part of their earnings to pay the costs linked to their activity and to remunerate themselves. This incentive to sell will naturally be lower from April, which will reduce the supply of new bitcoins on the market.

The American government invites itself to the party

At the same time, demand should increase. “Bitcoin ETF issues symbolize the adhesion of the big names in traditional finance to this digital currency, underlines Alexandre Baradez, head of market analysis at IG France. But also its democratization among small holders who have been reluctant until now to open an account on a cryptocurrency exchange platform, which is not necessarily transparent, or to hold an electronic wallet on the blockchain.” Less supply and more demand: an equation favorable to the progression of the price of bitcoin in 2024.

Only now, a protagonist could come and play spoilsport. The American government holds in its coffers a veritable war chest, more than 215,000 bitcoins resulting from judicial seizures, which it wishes to sell in the coming months. Enough to have a significant impact on the market.

.