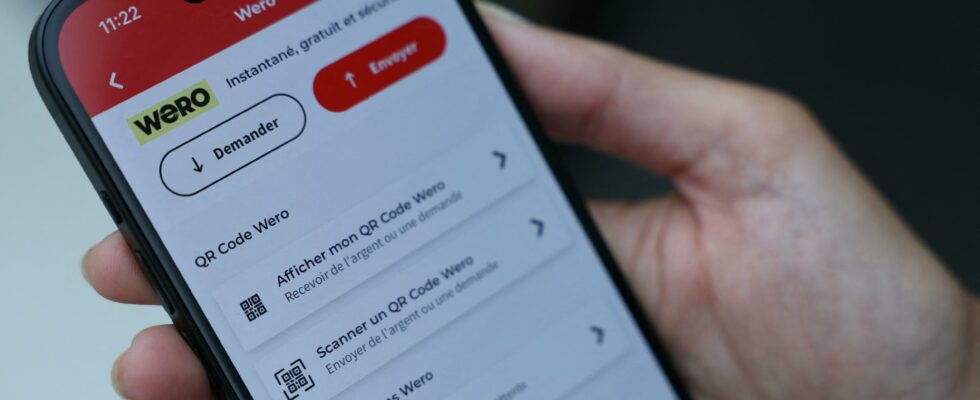

A group of fourteen major European banks, including all French banks, is launching a new instant payment service in France this Monday, September 30, called Wero. It succeeds Paylib, which will disappear at the beginning of next year. With this new application, banks will allow individuals to send and receive money by instant transfers from account to account, simply using a telephone number, an email address or a QR code generated by the application. This easy-to-use mode of operation should allow users to use it for their everyday transactions: reimbursing a friend, sending money to a loved one or paying for a service. First inaugurated in Germany, the service is intended to replace checks and cash.

European banks are entering a market dominated by PayPal and its younger competitor, Lydia. Wero, however, aims to be faster than the two online banks: connected directly to bank accounts (rather than to credit cards), the payment solution allows money transfers to be made without delay, compared to 1 to 2 days usually. Ultimately, it will be possible to send money to current account holders in four foreign countries: Germany, Belgium, the Netherlands and Luxembourg. The service is accessible from all banking applications — except for La Banque Postale, which has created a dedicated application. It will be free for all users.

The fourteen banks plan to enrich the functionalities of the application over the years: initially a simple payment solution, Wero should soon make it possible to pay merchants and professionals on the Internet, before being used in local businesses. The service can also be used to make purchases in installments or be used to share expenses between individuals.

This project, initially more ambitious, with a development cost estimated in billions of euros, has faced headwinds since its creation and has experienced several successive delays. It was largely revised downwards at the start of 2022 with the abandonment of a physical card project, due to disagreements between the different partner banks.

Compete with Visa and Mastercard

The launch of Wero also marks the failure of its predecessor, Paylib. Imagined by several French banks, the payment solution for 35 million subscribers has not gained enough followers to be sustained.

With this new service, major European banks hope to compete with sector giants like Visa, Mastercard, Apple Pay or Google Pay. Today, no national market “has the means to compete with major international competitors”, recalled the CEO of the European Payment Initiative (EPI), Martina Weimert. “We really need the pooling of investments and collective effort,” she stressed, particularly because of the billions of euros in fixed costs that this type of innovation requires.

To compete, banks intend to offer their customers and merchants more competitive rates than those of their two major competitors, the Americans Visa and Mastercard. To really take hold, Wero will need to be accepted by traders tomorrow. This is where the “real battle” should be played out, according to EPI.