(Finance) – The Wall Street stock market crosses the mid-session mark down after unemployment benefits exceeded analysts’ expectations while consumption proved weak. On the corporate front, focus on Twitter after Elon Musk, founder of Tesla, launched an unscheduled offer to acquire the entire capital of the social network, at $ 54.20 per share, valuing the group as a whole for $ 43 billion.

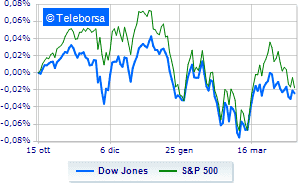

Among the US indices, the Dow Jones is substantially stable and is positioned on 34,566 points, while, on the contrary, widespread sales on theS & P-500, which continues the day at 4,412 points. The bad Nasdaq 100 (-1.66%); on the same line, negative changes for theS&P 100 (-0.97%).

Significant upside in the S&P 500 for the fund power. In the list, the sectors informatics (-1.64%), telecommunications (-1.39%) e secondary consumer goods (-1.26%) are among the best sellers.

Among the best Blue Chips of the Dow Jones, Nike (+ 4.74%), Caterpillar (+ 3.91%), DOW (+ 2.00%) e Coke (+ 0.87%).

The worst performances, on the other hand, are recorded on Salesforcewhich gets -2.53%.

Collapses Intelwith a decrease of 2.37%.

Sales hands on Applewhich suffers a decrease of 2.13%.

Sales focus on Microsoftwhich suffers a decline of 1.91%.

On the podium of the Nasdaq titles, Marriott International (+ 2.27%), Seagen (+ 1.57%), Fiserv (+ 1.11%) e Dollar Tree (+ 1.07%).

The strongest sales, on the other hand, show up on Pinduoduo Inc Spon Each Repwhich continues trading at -6.33%.

Bad performance for Atlassianwhich recorded a decline of 5.66%.

Black session for Mercadolibrewhich leaves a loss of 5.35% on the table.

At a loss Fastenalwhich falls by 4.55%.

Between macroeconomic variables most important in the North American markets:

Thursday 14/04/2022

14:30 USA: Retail sales, annual (previous 18.2%)

14:30 USA: Retail sales, monthly (expected 0.6%; previous 0.8%)

14:30 USA: Export prices, monthly (expected 2.2%; previous 3%)

14:30 USA: Import prices, monthly (expected 2.3%; previous 1.6%)

14:30 USA: Unemployment Claims, Weekly (Expected 171K Units; Previously 167K Units).