(Finance) – The New York Stock Exchange stops around par, after the disappointing data on unemployment benefits in the USA: the number of workers who applied for unemployment benefits for the first time has increased beyond expectations. Investors remain concerned about growth prospects and inflation. In this regard, insiders are waiting for the publication, tomorrow Friday, June 10, of the American consumer price index.

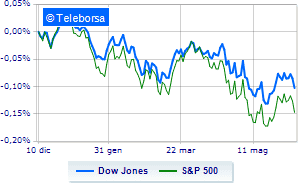

Among the US indices, Dow Jones stands at 32,871 points, while, on the contrary, theS & P-500, which continues the day below par at 4,107 points. Without direction the Nasdaq 100 (-0.19%); as well as, almost unchangedS&P 100 (-0.12%).

Sectors stand out in the S&P 500 basket consumer goods for the office (+ 0.46%) e secondary consumer goods (+ 0.43%). Among the worst on the list of the S&P 500, the sectors showed the greatest decline materials (-0.68%), power (-0.64%) e financial (-0.62%).

Among the best Blue Chips of the Dow Jones, Home Depot (+ 3.02%), 3M (+ 1.16%), Salesforce (+ 0.82%) e Cisco Systems (+ 0.61%).

The strongest sales, on the other hand, show up on Boeingwhich continues trading at -2.45%.

Walt Disney drops by 1.75%.

Decline for Goldman Sachswhich marks a -1.43%.

Under pressure Nikewith a sharp decline of 1.36%.

Between best performers of the Nasdaq 100, Nxp Semiconductors NV (+ 7.18%), Fortinet (+ 3.41%), Costco Wholesale (+ 3.38%) e Tesla Motors (+ 2.44%).

The worst performances, on the other hand, are recorded on Pinduoduo Inc Spon Each Repwhich gets -10.95%.

Bad performance for Modernwhich recorded a decline of 7.89%.

Black session for JD.comwhich leaves a loss of 6.59% on the table.

At a loss Mercadolibrewhich falls by 5.73%.

Between macroeconomic variables most important in the North American markets:

Thursday 09/06/2022

14:30 USA: Unemployment Claims, Weekly (Expected 210K Units; Previous 202K Units)

Friday 10/06/2022

14:30 USA: Consumption prices, yearly (8.3% expected; 8.3% before)

14:30 USA: Consumption prices, monthly (expected 0.7%; previous 0.3%)

4:00 pm USA: University of Michigan Consumer Confidence (expected 58.2 points; previous 58.4 points)

Tuesday 14/06/2022

14:30 USA: Production prices, monthly (previous 0.5%).