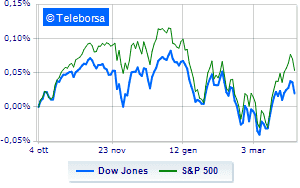

(Finance) – Wall Street continues the session below parcompared to the positive opening, reporting a variation equal to -0.2% on Dow Joneswhile, on the contrary, theS & P-500 it has a depressed trend and is trading below the levels of the eve of 4.515 points. Slightly negative the Nasdaq 100 (-0.61%); on the same trend, slightly down theS&P 100 (-0.42%). THE Treasury yields increased after the data on the labor market, strengthening forecasts for an aggressive increase in interest rates by the Fed to counter inflation.

Power (+ 0.45%) e consumer goods for the office (+ 0.45%) in good light on the S&P 500 list. In the lower part of the S&P 500 ranking, significant falls are manifested in the sectors industrial goods (-1.32%), Informatics (-1.18%) e financial (-0.56%).

On the macroeconomic front, i jobs in the non-agricultural sectors (non-farm payrolls) rose 431,000 last month, after an increase of 750,000 revised up in February. The unemployment rate it fell to 3.6%, close to its pre-pandemic low, and the labor force participation rate increased.

At the top of the ranking of American giants components of the Dow Jones, Visa (+ 1.59%), Merck (+ 0.98%), Wal-Mart (+ 0.81%) e Home Depot (+ 0.74%).

The strongest sales, on the other hand, show up on Intelwhich continues trading at -4.24%.

Collapses Walgreens Boots Alliancewith a decrease of 2.55%.

Suffers Caterpillarwhich shows a loss of 1.58%.

Prey of the sellers Applewith a decrease of 1.29%.

To the top between tech giants of Wall Streetthey position themselves NetEase (+ 7.54%), Baidu (+ 6.61%), Pinduoduo Inc Spon Each Rep (+ 5.16%) e Atlassian (+ 3.67%).

The worst performances, on the other hand, are recorded on Qualcommwhich gets -6.56%.

Sales hands on Old Dominion Freight Linewhich suffers a decrease of 6.24%.

Bad performance for CSXwhich recorded a drop of 5.77%.

Black session for Micron Technologywhich leaves a loss of 4.50% on the table.

Between macroeconomic quantities most important of the US markets:

Friday 01/04/2022

14:30 USA: Unemployment rate (expected 3.7%; previous 3.8%)

14:30 USA: Change in employees (490K units expected; previous 750K units)

15:45 USA: Manufacturing PMI (expected 58.5 points; preceding 57.3 points)

4:00 pm USA: ISM manufacturing (expected 59 points; previous 58.6 points).