(Finance) – The Wall Street stock exchange continues to be mixed with the investors always focused on central banks while they wait for the publication of the minutes of the last Federal Reserve meeting, arriving this week. During its October meeting, the US central bank raised interest rates by 75 basis points, taking them to between 3.75% and 4%.

This week there will be holiday trades ahead of the break Thursday, November 24, for Thanksgiving, Thanksgiving Day. The US stock exchange will remain closed to then reopen the following day with early closing, at 1pm New York time.

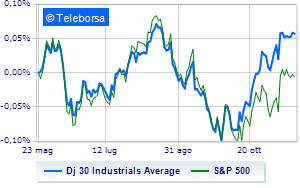

Among US indices, the Dow Jones shows a timid rise of 0.11%, while, on the contrary, theS&P-500, which drops 0.22%. Also negative NASDAQ 100 (-0.77%); weak theS&P 100 (-0.19%).

Among the best Blue Chips of the Dow Jones, Walt Disney (+5.71%), Walgreens Boots Alliance, (+1.71%), Procter & Gamble (+1.26%) and Merck (+1.25%).

The strongest sales, however, fell on intelwhich finished trading at -2.37%.

In red Salesforce,which shows a marked decrease of 2.37%.

The negative performance of United Healthwhich drops by 2.21%.

Apple drops by 1.88%.

Between macroeconomic quantities most important of the US markets:

Wednesday 11/23/2022

2.30pm USA: Durable goods orders, monthly (exp. 0.3%; prev. 0.4%)

2.30pm USA: Initial Jobless Claims, Weekly (Expected 225K; Previously 222K)

3.45pm USA: Composite PMI (previously 48.2 points)

3.45pm USA: Manufacturing PMI (previously 49.9 points)

3.45pm USA: PMI services (previous 47.8 points).