(Finance) – The New York Stock Exchange closes around parity, with investors seeing a rate cut by the Fed increasingly closer, already in the first quarter of 2024, thanks to the cooling of the American labor market and the gradual control of inflation.

Among US indices, the Dow Jones which stands at 37,650 points, while, on the contrary, theS&P-500 it has a depressed trend and trades below the levels of the day before at 4,769 points. Under parity the Nasdaq 100, which shows a decline of 0.36%; with the same direction, slightly negativeS&P 100 (-0.3%).

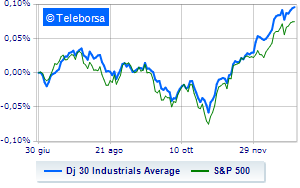

Despite the weakness recorded in this last session of 2023, the American stock market is set to conclude a very positive year: the Dow Jones up by 14.5%, the S&P 500 by 26% and the Nasdaq Composite by 47%.

Strong nervousness and generalized losses in the S&P 500 across all sectors, without exception. Among the worst performers on the S&P 500 list, the sectors fell the most utilities (-0.69%), telecommunications (-0.60%) e secondary consumer goods (-0.50%).

Bad day for all the Blue Chips of the Dow Jones, which show a negative performance.

The worst performances are recorded on Walgreens Boots Alliancewhich gets -2.35%.

Disappointing Home Depotwhich lies just below the levels of the day before.

Lame Salesforcewhich shows a small decrease of 0.65%.

Modest descent for Dowwhich drops a small -0.65%.

Between best performers of the Nasdaq 100, JD.com (+1.14%), T-Mobile US (+1.10%), Modern (+1.02%) e O’Reilly Automotive (+0.91%).

The worst performances, however, are recorded on Paypalwhich gets -2.42%.

Negative session for Walgreens Boots Alliancewhich shows a loss of 2.35%.

Under pressure Polishedwhich suffered a decline of 2.11%.

It slides Warner Bros Discoverywith a clear disadvantage of 2.05%.