(Finance) – Weak session on Wall Streetwith investors anxiously awaiting the results of Nvidiawhich will be released after today’s market close, from which to also evaluate the outlook regarding chip demand related to artificial intelligence for the next few months. Meanwhile, the company’s declines drag the Nasdaq lower.

Always on the front of quarterlythey disappointed Palo Alto Networks, Teladoc And SolarEdge Technologies, which collapsed after providing weak forecasts. They move in the opposite direction Amazon And Walgreens Boots Allianceafter S&P Dow Jones Indices announced that the e-commerce giant will replace the pharmacy chain in Dow Jones Industrials Average (DJIA).

From the minutes of the Fed’s meeting at the end of January it emerged that Policymakers have not signaled any urgency to cut ratesas further confidence is needed to ensure inflation continues to slow towards target, with most participants highlighting “the risks of acting too quickly to ease policy stance”.

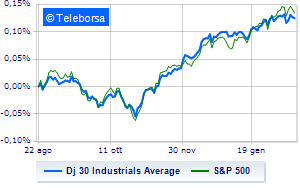

Looking at the main indicesThe Dow Jones shaves 0.29%; along the same lines, with a slight decrease inS&P-500, which continues the day below par at 4,957 points. Negative changes for Nasdaq 100 (-1.02%); on the same trend, below parity theS&P 100which shows a decline of 0.41%.

In good evidence in the S&P 500 i compartments power (+1.71%) e utilities (+0.87%). The sector informaticswith its -1.54%, is the worst of the market.

At the top of the rankings American giants components of the Dow Jones, Nike (+2.00%), Dow (+1.92%), Caterpillar (+1.24%) e Verizon Communications (+1.14%).

The strongest sales, however, occur at Intel, which continues trading at -3.04%. Sales up Walgreens Boots Alliance, which recorded a decline of 2.85%. Negative session for IBM, which shows a loss of 1.79%. Under pressure Salesforcewhich suffered a decline of 1.72%.

On the podium of Nasdaq stocks, Exelon (+3.58%), CoStar (+2.14%), Analog Devices (+1.88%) e Diamondback Energy (+1.85%).

The worst performances, however, are recorded on Palo Alto Networks, which obtains -27.04%. Negative session for Zscaler, which drops by 14.16%. Significant losses for CrowdStrike Holdings, down 9.53%. Breathless Verisk Analyticswhich fell by 4.49%.