(Tiper Stock Exchange) – Wall Street is little moved after producer prices rose more-than-expected in November (+0.3% on month and +7.4% on year), curbing hopes that inflation is cooling down and expectations of a so-called “pivot” of monetary policy towards less aggressive actions on interest rates . Analysts continue to expect the Federal Reserve to make a increase of 50 basis points at the end of the December meeting, one level lower than the previous four increases. At the same time, concerns about the central bank’s ability to implement a “soft landing” have grown.

“The combination of (still) high job openings, low weekly jobless claims data and robust wage growth point to the need for continued tightening of financial conditions,” said Mark Dowding, CIO of BlueBay. by the way, we believe that the FED is not done yet and that next week will not be overly accommodating“.

After a very positive November, risk assets have begun to falter and there is a sense among investors that there may be another crisis before the end of the year, according to Dowding, who points out that “what looked like a strong year-end risk rally is struggling to sustain traction”.

Little moved the titles Microsoft to activisionafter the Federal Trade Commission launched a lawsuit to prevent the Redmond-based software giant from taking over the video game maker. The FTC has said it intends to prevent Microsoft from gaining control over one of the world’s largest independent game studios and hurting the competition.

On the front of quarterly, costco (large US chain of wholesale hypermarkets) recorded revenues and profits below expectations due to the increase in costs. Lululemon (Canadian sportswear retailer and Nasdaq-listed company) reported a lower-than-expected outlook after a positive third quarter.

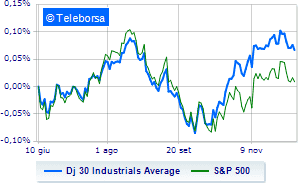

Caution prevails on Wall Street, with the Dow Jones which continues the session with a slight drop of 0.24%, while, on the contrary, a day without infamy and without praise for theS&P-500, which remains at 3,958 points. Without direction the NASDAQ 100 (+0.01%); on the same trend, almost unchanged theS&P 100 (+0.01%).

Among the best Blue Chips of the Dow Jones, Walt Disney (+1.87%), Salesforce, (+1.78%), Apple (+1.25%) and Verizon Communication (+1.17%).

The strongest sales, on the other hand, show up Chevronswhich continues trading at -2.32%.

The negative performance of Wal-Martwhich drops by 1.55%.

Amgen drops by 1.53%.

Moderate contraction for Merckwhich suffers a drop of 1.23%.

Between protagonists of the Nasdaq 100, document sign, (+15.90%), Netflix (+5.43%), Tesla Motors (+4.17%) and broadcom (+3.49%).

The worst performances, however, are recorded on Lululemon Athleticawhich gets -12.08%.

Hands-on sales Lucid Groupwhich suffers a decrease of 5.00%.

Bad performance for Dexcomwhich records a drop of 4.91%.

Decided decline for Modernwhich marks a -3.41%.

Between macroeconomic variables of greatest weight in the North American markets:

Friday 09/12/2022

2.30pm USA: Production prices, annual (expected 7.2%; previous 8.1%)

2.30pm USA: Production prices, monthly (0.2% expected; previous 0.3%)

4:00 pm USA: Inventories wholesale, monthly (exp. 0.8%; prev. 0.6%)

4:00 pm USA: University of Michigan Consumer Confidence (expected 56.9 points; previous 56.8 points)

Tuesday 12/13/2022

2.30pm USA: Consumption prices, annual (previous 7.7%).