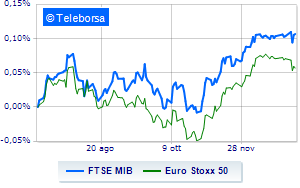

(Finance) – Weak session for European stock markets, which reduced their declines in the afternoon, after U.S. Labor Department data showed nonfarm payrolls rose by 216,000 last month and beat market expectations. Piazza Affari stands out, ending the day in positive territory, thanks above all to the good performance of the banks.

Still on the macroeconomic front, this morning the preliminary reading on theDecember inflation in the eurozone indicated a reacceleration of the cost of living, to a trend rate of 2.9% from 2.4% in November, although below the expectations of 3% percent and due to basic effects regarding the energy sector.

L’Euro / US Dollar maintains the position substantially stable at 1.097. Slight increase ingold, which rises to 2,050.4 dollars an ounce. Strong rise for the petrolium (Light Sweet Crude Oil), which posted a gain of 1.94%.

Slight worsening of spreadwhich rises to +167 basis points, an increase of 2 basis points, with the yield of the 10-year BTP equal to 3.81%.

Among the Euroland indices remains close to parity Frankfurt (-0.14%), small loss for Londonwhich trades at -0.43%, and is wavering Pariswhich lost 0.40%.

No significant change in closing for Milanese price listwith the FTSE MIB which stands at 30,441 points on the day before; on the same line, colorless the FTSE Italia All-Share, which closed the session at 32,512 points, on the previous day’s levels. Under parity the FTSE Italia Mid Cap, which shows a decline of 0.26%; as well as, slightly negative FTSE Italia Star (-0.33%).

From the closing data of Milan, the exchange value in the session of 5/01/2024 it was equal to 2.28 billion euros, down (-9.43%), compared to the previous 2.52 billion; while the volumes traded went from 0.64 billion shares in the previous session to 0.6 billion.

Between best performers of Milan, highlighted BPER (+1.96%), Saipem (+1.95%), BPM desk (+1.74%) e Intesa Sanpaolo (+1.20%).

The steepest declines, however, occurred on Record yourself, which closed the session at -1.44%. Basically weak Inwit, which recorded a decline of 1.13%. It moves below parity Fineco, highlighting a decrease of 1.06%. Moderate contraction for Campariwhich suffers a decline of 1.01%.

Among the protagonists of the FTSE MidCap, Ariston Holding (+4.93%), De Nora Industries (+2.58%), MFE B (+1.78%) e Technoprobe (+1.36%).

The strongest sales, however, hit Saras, which ended trading at -6.16%. Negative session for Caltagirone SpA, which shows a loss of 3.23%. Under pressure Digital Value, which suffered a decline of 2.53%. It slides GVSwith a clear disadvantage of 2.07%.