(Finance) – A day marked by caution for European stock lists. On the other hand, the performance of Piazza Affari was excellent, which takes a large lead over the rest of Europe. Meanwhile on Wall Street theS&P-500 marks an increase of 0.39%: the market lost momentum after the Federal Reserve Chairman Jerome Powell, curbed the initial enthusiasm. The banker, in his speech at the Jackson Hole symposium, announced that “the Fed is ready to raise rates again if necessary”. In the evening the speech of the governor of the ECB, Christine Lagarde.

On the currency market, caution prevails overEuro / US Dollar, which continues the session with a slight drop of 0.21%. Weak session forgold, which trades 0.36% lower. Oil (Light Sweet Crude Oil) continues trading, with an increase of 0.82%, to 79.7 dollars per barrel.

On equality it spreadswhich remains at +169 basis points, with the yield on the ten-year BTP standing at 4.23%.

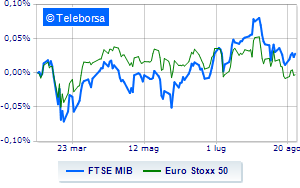

Among the markets of the Old Continent no cues Frankfurtwhich does not show significant changes in prices, stops Londonwhich marks almost nothing done, and moves modestly up Paris, showing an increase of 0.21%. Piazza Affari closes the session with a fractional gain on FTSEMIB by 0.49%; along the same lines, the FTSE Italia All-Share it advances fractionally, reaching 30,171 points.

Between best performers of Milan, in evidence Iveco (+4.18%), Unicredit (+1.37%), Italgas (+1.36%) and snam (+1.28%).

The strongest declines, however, occur on Nexiwhich continues the session with -0.85%.

It moves below parity MPS Bankshowing a decrease of 0.83%.

Moderate contraction for Tenariswhich suffers a drop of 0.56%.

Among the protagonists of the FTSE MidCap, Alerion Clean Power (+3.10%), Juventus (+2.93%), Zignago Glass (+2.64%) and Acea (+2.09%).

The strongest declines, however, occur on Intercoswhich continues the session with -2.16%.

Bad sitting for Saphiluswhich shows a loss of 1.86%.

Under pressure GV extensionwhich shows a drop of 1.77%.

Slide Antares Visionwith a clear disadvantage of 1.52%.