(Finance) – Milan is weakin the wake of the other Eurozone stock exchanges, in a session full of macroeconomic events, starting with that of the People’s Bank of China which confirmed interest rates, as expected by the market. In UK inflation, in November, fell against growth estimates, which is very encouraging news for the Bank of England in its fight against high price pressures. From Germany l‘Gfk index showed an improvement in consumer sentiment. in the afternoon, the report on consumer confidence and sales of existing homes is expected from the USA.

On the currency market, theEuro / US Dollar the session continues at the levels of the day before, reporting a change of -0.14%. L’Gold it is essentially stable at 2,040.1 dollars an ounce. Oil (Light Sweet Crude Oil) saw a slight rise, rising to 74.63 dollars per barrel.

On equality, yes spreadwhich remains at +163 basis points, with the yield on the 10-year BTP standing at 3.61%.

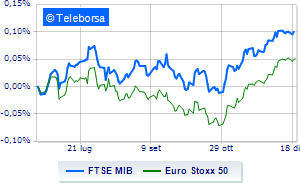

In the European stock market scenario without momentum Frankfurtwhich trades with a +0.19%, a positive trend for Londonwhich advances by a discreet +0.77%, and Paris advances by 0.28%. The Milanese price list continues the session just below parity, with the FTSE MIB which shaves 0.41%; along the same lines, slightly decreasing FTSE Italia All-Sharewhich continues the day below par at 32,325 points.

Between best performers of Milan, highlighted Telecom Italia (+4.04%), Inwit (+0.84%), ENI (+0.68%) e Saipem (+0.63%).

The worst performances, however, are recorded on BPM deskwhich gets -2.10%.

Prey for sellers BPERwith a decrease of 1.57%.

Small loss for MPS Bankwhich trades at -1.3%.

He hesitates Leonardowhich lost 1.19%.

Among the protagonists of the FTSE MidCap, Maire Tecnimont (+2.53%), D’Amico (+1.37%), Ariston Holding (+1.30%) e Seco (+1.21%).

The steepest declines, however, occur at De Nora Industrieswhich continues the session with -5.27%.

They focus on sales MortgagesOnlinewhich suffers a decline of 3.80%.

Sales up Cementirwhich recorded a decline of 2.12%.

Negative session for Pharmanutrawhich shows a loss of 1.79%.