(Tiper Stock Exchange) – Negative session for the European stock exchanges, with Piazza Affari the worst. To weigh in the exchanges of the Italian Stock Exchange is the coupon detachment expected today by many big names in Palazzo Mezzanotte, including Understanding, Mediobanca, Mediolanum Bank, Italian post, Register, Tenaris And Triad.

The Economic Maneuver arrives today in the CDM, with a package of 32 billion. Among the hypotheses under consideration is the zeroing of VAT on bread, pasta and milk. On pensions, the government is working at 41+62, while the tax wedge is moving towards cutting the tax wedge by up to 3 points for the lowest incomes. On the flat tax, an increase in the threshold up to 85 thousand euros for the self-employed is assumed.

According to the president of the Italian Banking Association, Antonio Patuelligovernment and parliament must work to prevent the delay accumulated by Italy in the process of drawing up the 2023 budget due to the elections leading to theprovisional exercise. “The markets and speculation are absolutely unpredictable. My hope is that there is institutional awareness to allow the conclusion of the budget law within the year” she underlined during a seminar.

Sharply down Saipemon which weighs the decision of the Algerian Supreme Court to reject the appeal of the company and the other appellants against the decision of the Court of Appeal of Algiers last June in the context of the proceeding relating to the GNL3 Arzew project.

Keep sinking Treviin volatility auction down 10%, after the collapse on Friday following the approval by the board of directors of two capital increases for a total of 51 million euros.

Today REVO Insurance is moved from Euronext Growth Milan to Euronext STAR Milanrepresenting the third admission to the segment since the beginning of the year and bringing the number of companies currently listed on Euronext STAR Milan to 77.

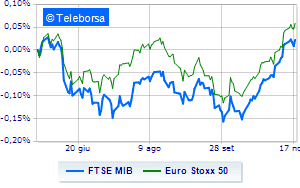

The indices of Piazza Affari and the other main European lists are all negative.

L’Euro / US Dollar is down (-0.95%) and settles at 1.023. Widespread sales ongold, which continues the day at $1,738.1 an ounce. Widespread sales on oil (Light Sweet Crude Oil), which continues the day at 79.4 dollars per barrel.

Salt it spreadssettling at +188 basis points, with an increase of 4 basis points, with the yield on the ten-year BTP equal to 3.92%.

Among the European lists moderate contraction for Frankfurtwhich suffers a drop of 0.47%, colorless Londonwhich does not record significant changes, compared to the previous session, and without momentum Pariswhich trades with -0.19%.

At Piazza Affari, the FTSEMIB it is down (-0.89%) and stands at 24,456 points; along the same lines, the FTSE Italia All-Share it lost 0.86%, continuing the session at 26,450 points.

Slightly negative the FTSE Italia Mid Cap (-0.51%); on the same line, in red the FTSE Italy Star (-0.78%).

At the top of the ranking of the most important titles of Milan, we find BPM desk (+1.75%), Leonardo (+1.38%), Prysmian (+1.29%) and BPER (+1.18%).

The worst performances, among those who do not detach the coupon, are registered on Saipemwhich gets -5.12%.

Nexi drops by 2.32%.

Decided decline for Telecom Italywhich marks a -1.88%.

Among the protagonists of the FTSE MidCap, Antares Vision (+2.05%), Illimity Bank (+1.22%), Webuild (+1.12%) and Rai Way (+1.06%).

The strongest declines, however, occur on ERGwhich continues the session with -2.54%.

Under pressure Replywith a sharp drop of 2.48%.

Undertone Datalogic showing a filing of 1.47%.

Disappointing GV extensionwhich lies just below the levels of the eve.

Between macroeconomic variables heavier:

Monday 11/21/2022

08:00 Germany: Production prices, annual (expected 41.5%; previous 45.8%)

08:00 Germany: Production prices, monthly (0.9% expected; previous 2.3%)

Tuesday 11/22/2022

4:00 pm European Union: Consumer confidence (expected -30 points; previous -27.6 points)

Wednesday 11/23/2022

10am European Union: Manufacturing PMI (previously 46.4 points)

10am European Union: Composite PMI (expected 47.5 points; previous 47.3 points).