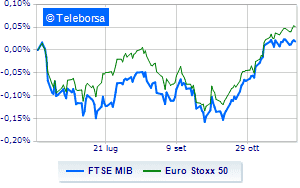

(Finance) – The main European stock exchanges ended in red after the indications of solidity from the US labor market cast doubt on the prospects of a possible slowdown in the pace of rate hikes by the Federal Reserve, already from meeting scheduled for this month.

On the foreign exchange market, theEuro / US Dollar the session continued at the previous levels, reporting a variation of -0.04%. Slight drop ingold, which drops to $1,793.2 an ounce. No significant changes for the oil market, with oil (Light Sweet Crude Oil) settling on the previous day’s values at 81.39 dollars per barrel.

Gallop back spreadswhich stands at +190 basis points, with a strong increase of 13 basis points, while the 10-year BTP shows a yield of 3.76%.

Among the main European Stock Exchanges resistant Frankfurtwhich marks a small increase of 0.27%, nothing done for London, which changes hands on parity; colorless Paris, which does not record significant changes, compared to the previous session. Closing in fractional downward for Piazza Affari, with the FTSEMIB which leaves 0.26% in the crowd.

At the close of the Milan Stock Exchange, the exchange value in today’s session it appears to have been equal to 2.33 billion euros, a decided decrease (-23.88%), compared to the previous session which had seen the negotiation of 3.06 billion euros; while the volumes traded went from 0.87 billion shares in the previous session to today’s 0.78 billion.

Between best performers of Milan, in evidence amplifier (+3.22%), General Bank (+2.38%), Campari (+1.99%) and Phinecus (+1.94%).

The worst performances, however, were recorded on Monclerwhich closed at -3.23%.

In red Telecom Italywhich shows a marked decrease of 2.06%.

The negative performance of Stellantiswhich drops by 2.05%.

ERG drops by 2.03%.

At the top of the mid-cap rankings from Milan, GV extension (+7.36%), OVS extension (+4.36%), wiit (+2.86%) and Dry (+2.67%).

The strongest declines, however, occurred on De Nora Industrieswhich closed the session at -4.81%.

Decided decline for Brunello Cucinelliwhich marks a -3.03%.

Under pressure Juventuswith a sharp drop of 1.87%.

Undertone Antares Vision showing a filing of 1.39%.

Between macroeconomic quantities most important:

Friday 02/12/2022

08:00 Germany: Trade balance (expected 5.2 billion euros; previous 2.8 billion euros)

08:45 France: Industrial Production, Monthly (previously -0.9%)

11:00 am European Union: Production prices, annual (expected 31.5%; previous 41.9%)

11:00 am European Union: Production prices, monthly (exp. -2%; previous 1.6%)

2.30pm USA: Unemployment rate (expected 3.7%; previous 3.7%).