(Finance) – Milan is weakin the wake of the other Eurozone stock exchanges, after the mixed closing of the US markets in Friday’s session and the Asian ones this morning.

Investors are waiting for the third quarter GDP data in China and indications oninflation in Japanarriving this week, even if all eyes are on the Arab-Israeli conflict and on fears of escalation that could potentially involve other Middle Eastern countries.

On the currency market, theEuro / US Dollar, which continues the session at the levels of the day before and stops at 1.053. Widespread sales ongold, which continues the day at $1,913.2 an ounce. Weak session for oil (Light Sweet Crude Oil), which trades with a drop of 0.16%.

On equality, yes spreadwhich remains at +201 basis points, with the yield on the 10-year BTP standing at 4.79%.

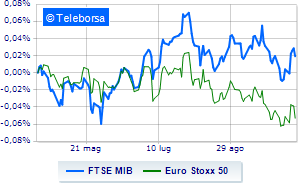

Among the European price lists substantially weak Frankfurtwhich recorded a decrease of 0.49%, colorless Londonwhich does not record significant changes compared to the previous session, and moves below parity Parishighlighting a decrease of 0.43%. In Milanmoves below parity FTSE MIB, which drops to 28,076 points, with a percentage difference of 0.57%; on the same line, the FTSE Italia All-Sharewhich relegates to 29,890 points.

Among the best Blue Chips of Piazza Affari, small steps forward for Leonardowhich marks a marginal increase of 1.43%.

Moderately positive day for Nexiwhich rises by a fractional +1.41%.

Sitting without momentum for ERGwhich reflects a moderate increase of 1.40%.

Small step forward for Amplifonwhich shows an increase of 0.76%.

The strongest sales, however, occur at Telecom Italiawhich continues trading at -3.94% after KKR’s offer for the TLC giant’s network.

He suffers MPS Bankwhich highlights a loss of 2.78%.

Prey for sellers Saipemwith a decrease of 2.12%.

They focus on sales Stellantiswhich suffers a decline of 2.01%.

At the top of the mid-cap stocks ranking from Milan, Pharmanutra (+1.46%), MFE B (+1.43%), Caltagirone SpA (+1.30%) e Tinexta (+0.96%).

The steepest declines, however, occur at Eurogroup Laminationswhich continues the session with -4.13%.

Sales up Secowhich recorded a decline of 3.24%.

Negative session for Alerion Clean Powerwhich shows a loss of 2.18%.

Moderate contraction for Brembowhich suffers a decline of 1.36%.