(Tiper Stock Exchange) – The financial session of the European stock exchanges continues under the sign of a downward trend, Piazza Affari included. Signs of weakness also come from US derivatives. Investor attention remains focused on central banks, in view of the ECB and Fed meetings scheduled for the first two days of February. The Eurotower is expected to be more aggressive than the Jerome Powell-led central bank. “The ECB will continue to raise interest rates until it has achieved its goal of bringing inflation back in line with its long-term target of 2%”. This was confirmed by two heavyweights of the Board, the president of the Bundesbank Joachim Nagel, and the governor of the Banque de France Francois Villeroy de Galhau.

On the macro front, the German IFO index signaled an improvement in German business confidence in January. Great expectation tomorrow when the preliminary GDP data will come from the United States of the fourth quarter. On the corporate side, the Board of Directors met today Tod’s for the approval of the accounts, while the quarterly season proceeds briskly both in the United States and in Europe.

On the foreign exchange market, theEuro / US Dollar it leaves 0.24% on the floor for now. L’Gold the session continued just below parity, with a drop of 0.68%. Light Sweet Crude Oil shows a fractional gain of 0.29%.

Consolidate the levels of the eve lo spreadssettling at +181 basis points, with the yield on the ten-year BTP standing at 3.89%.

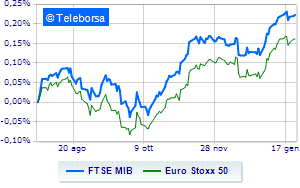

Among the indices of Euroland modest descent for Frankfurtwhich yields a small -0.27%, colorless London, which does not record significant changes, compared to the previous session; thoughtful Paris, a fractional decline of 0.28%. Caution prevails in Piazza Affari, with the FTSEMIB which continues the session with a slight drop of 0.32%, stopping the series of three consecutive rises, which began last Friday; along the same lines, it yields to sales the FTSE Italia All-Sharewhich recedes to 27,988 points.

Between best performers of Milan, in evidence Iveco (+4.13%), Leonardo (+3.19%), ERG (+1.65%) and Buzzi Unicem (+1.02%).

The strongest sales, on the other hand, show up Interpumpwhich continues trading at -1.96%.

Under pressure Nexiwhich shows a drop of 1.82%.

He hesitates Registerwith a modest drop of 1.36%.

Slow day for Inwitwhich marks a drop of 1.28%.

At the top among Italian stocks a mid-cap, Saras (+2.88%), Ascopiave (+1.90%), Mondadori (+1.67%) and Juventus (+1.56%).

The worst performances, however, are recorded on GV extensionwhich gets -3.01%.

Slide Luvewith a clear disadvantage of 2.43%.

In red Saphiluswhich shows a marked decrease of 2.21%.

The negative performance of Salcef Groupwhich drops by 2.12%.

Among the data relevant macroeconomics:

Wednesday 01/25/2023

08:00 United Kingdom: Production prices, annual (expected 16.4%; previous 17.5%)

08:00 United Kingdom: Production prices, monthly (expected 0.3%; previous 1%)

9:00 am Spain: Production prices, annual (previous 20.5%)

10am Germany: IFO index (expected 90.2 points; previous 88.6 points)

4.30pm USA: Oil inventories, weekly (exp 971K barrels; prev 8.41M barrels).