(Finance) – The values for the Milan Stock Exchange are stablewhich finds impetus from the positive performance highlighted by the securities of the banking sector, while most of the European markets move significantly down, albeit above the lows of the day thanks to the positive balance of the American stock market, (theS & P-500 boasts a progress of 0.31%). Investors have chosen a cautious stance after the new round of macro arrived today from the United States, monitoring the moves of central banks, in the face of the impacts of the lockdowns in Asia and the progress of the war in Ukraine.

On the currency market, theEuro / US dollar trading continues at 1.06 Euro / US Dollar, with an increase of 1.28%. Strong earnings day forgold, which marks an increase of 1.59%. Crude Oil (Light Sweet Crude Oil) continued the session higher and advanced at $ 110.3 per barrel.

Increase it a little spreadwhich reaches +195 basis points, with a slight increase of 3 basis points, with the yield of the 10-year BTP equal to 2.89%.

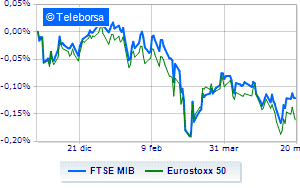

Among the European lists the negative performance of Frankfurtwhich falls by 0.90%, collapses Londonwith a decrease of 1.82%; Paris drops by 1.26%. Piazza Affari closes the session at the levels of the day before, reporting a variation equal to -0.09% on FTSE MIBwhile, on the contrary, it closes in reverse the FTSE Italia All-Sharewhich slips to 26,301 points.

The exchange value in today’s session in Piazza Affari it amounted to 1.91 billion euros, down from 2.07 billion on the eve of the day; while the volumes traded went from 0.54 billion shares of the previous session to today’s 0.54 billion.

Between best Italian stocks large cap, in evidence DiaSorinwhich shows a strong increase of 2.25%.

It stands out Saipem which marks an important progress of 2.18%.

Fly Banco BPMwith a marked increase of 2.17%.

It shines Prysmianwith a strong increase (+ 2.03%).

The worst performances, however, were recorded on Amplifonwhich closed at -2.98%.

Sales hands on Tenariswhich suffers a decrease of 2.58%.

Bad performance for Campariwhich recorded a decline of 2.10%.

Decline for CNH Industrialwhich marks a -1.9%.

Top of the ranking of mid-cap stocks from Milan, Danieli (+ 4.81%), Wiit (+ 3.59%), MPS Bank (+ 2.87%) e Alerion Clean Power (+ 2.45%).

Stronger sales, on the other hand, fell on Antares Visionwhich ended trading at -3.70%.

Black session for Brunello Cucinelliwhich leaves a loss of 3.66% on the table.

At a loss MARRwhich falls by 3.31%.

Heavy Ferragamowhich marks a drop of as much as -2.97 percentage points.

Among macroeconomic appointments which will have the greatest influence on market trends:

Thursday 19/05/2022

00:50 Japan: Core machinery orders, monthly (expected 3.7%; previous -9.8%)

01:50 Japan: Trade balance (expected ¥ -1.150 billion; previous ¥ -414.1 billion)

14:30 USA: PhillyFed (16 points expected; previous 17.6 points)

14:30 USA: Unemployment Claims, Weekly (Expected 200K Units; Previously 197K Units)

4:00 pm USA: Leading indicator, monthly (expected 0.3%; preceding 0.1%).