(Finance) – Positive closing for Piazza Affari, best Stock Exchange in a more prudent Europe that looks to the Fed meeting this week, after that of the ECB, in the last eighth. In Germany, the confidence climate of German companies measured by the IFO institute worsened more than expected. The index fell to its lowest value since June 2020.

On the currency market, theEuro / US dollar, which continues the session on the eve of the levels and stops at 1.022. L’Gold the session continues just below par, with a drop of 0.57%. Strong rise for oil (Light Sweet Crude Oil), which posted a gain of 1.95%. Gas prices rose after Gazprom announced a new supply cut through Nord Stream on Wednesday. The pipeline between Russia and Germany will only operate at 20% of its capacity.

Unchanged it spreadwhich stands at +232 basis points, with the yield on the ten-year BTP standing at 3.29%.

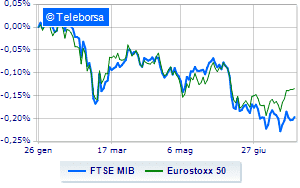

Among the European lists moderate contraction for Frankfurtwhich suffers a decline of 0.33%, modest performance for London, which shows a moderate rise of 0.41%; resistant Paris, which marks a small increase of 0.33%. In Piazza Affari, the FTSE MIB ended the day with an increase of 0.80%, to 21,383 points, while, on the contrary, the FTSE Italia All-Share remains at 23.307 points.

At the close of the Milan Stock Exchange, the exchange value in the today’s session was equal to 1.66 billion euro, a marked decrease (-36.42%), compared to the previous session which had seen the negotiation of 2.6 billion euro; while the volumes traded went from 0.86 billion shares of the previous session to today’s 0.55 billion.

Top of the ranking of the most important titles of Milan, we find Saipem (+ 4.15%), Banco BPM (+ 3.15%), BPER (+ 2.59%) e Unicredit (+ 1.98%).

The strongest declines, on the other hand, occurred on Telecom Italiawhich closed the session at -2.69%.

At a loss Interpumpwhich falls by 2.49%.

Heavy DiaSorinwhich marks a drop of as much as -2.38 percentage points.

The negative performance of Amplifonwhich falls by 1.80%.

Top of the ranking of mid-cap stocks from Milan, Ascopiave (+ 4.76%), Banca Ifis (+ 3.00%), Italmobiliare (+ 2.83%) e Carel Industries (+ 2.82%).

Stronger sales, on the other hand, fell on Saint Lawrencewhich ended trading at -3.21%.

Negative sitting for Safilowhich falls by 2.78%.

Sensitive losses for Technogymdown 2.01%.

ENAV drops by 1.75%.

Among macroeconomic appointments which will have the greatest influence on market trends:

Monday 25/07/2022

10:00 Germany: IFO Index (expected 90.2 points; preceding 92.2 points)

Tuesday 26/07/2022

9:00 am Spain: Production prices, annual (previous 43.6%)

15:00 USA: FHFA house price index, monthly (previous 1.6%)

15:00 USA: S&P Case-Shiller, annual (expected 20.8%; previous 21.2%)

4:00 pm USA: New house sales, monthly (previous 10.7%).