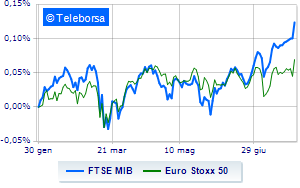

(Tiper Stock Exchange) – Modest decrease for the Milan Stock Exchange, while the rest of Europe is holding its previous values, following the indications received from the central banks (Fed and ECB) about a possible pause in interest rate hikes. This morning there central bank of Japan left rates unchanged and announced changes in yield curve control strategy.

On the currency market, the session rose slightly due toEuro / US Dollar, which advances to 1.101. L’Gold trading continues with a fractional gain of 0.51%. The oil market was substantially stable, continuing the session at the levels seen on the eve with oil (Light Sweet Crude Oil) trading at 80 dollars per barrel.

Slight improvement spreadswhich drops to +161 basis points, with a drop of 3 basis points, while the yield on the 10-year BTP stands at 4.07%.

Among the European lists Frankfurt is stable, posting a moderate +0.05%, a cautious trend for London, which shows a performance of +0.06%; little moved Paris, which shows a -0.2%. The Milanese price list continues the session just below parity, with the FTSEMIB which limits 0.24%; along the same lines, depressed the FTSE Italia All-Sharetrading below the previous day’s levels at 31,550 points.

Between best performers of Milan, in evidence Azimuth (+3.88%) and General Bank (+2.71%) thanks to the corporate results announced the day before. Well also, Iveco (+2.16%) and Intesa Sanpaolo (+1.77%): the latter, after the strong first half year, sees the 2023 profit well over 7 billion.

The strongest declines, however, occur on ERGwhich continues the session with -4.66%.

Under pressure STMicroelectronicswhich shows a drop of 3.36%.

Slide Prysmianwith a clear disadvantage of 1.76%.

He hesitates MPS Bankwhich yields 1.20%.

Between best stocks in the FTSE MidCap, Eurogroup Laminations (+3.14%), Fincantieri (+2.31%), Cembre (+1.55%) and Caltagirone SpA (+1.52%).

The strongest declines, however, occur on Alerion Clean Powerwhich continues the session with -4.55%.

In red Piaggiowhich shows a marked decrease of 2.53%.

The negative performance of Replywhich drops by 2.26%.

Saras drops by 1.88%.