(Tiper Stock Exchange) – Cautious session for the main stock exchanges of the Old Continent. Uncertainty also exists in the Milan market which is positioned on the same line. Meanwhile on US markets theS&P-500which records a decrease of 0.37%, with the focus still concentrated on the probability of US default, in the hope that a bipartisan agreement will be reached in time in Congress.

Basically stable theEuro / US Dollar, which continues the session on the previous day’s levels and stops at 1.086. Swap into reversegold, which slips to $1,997.7 an ounce. Negative day for oil (Light Sweet Crude Oil), which continues trading at 70.68 dollars a barrel, down 0.61%.

Unchanged it spreadswhich stands at +187 basis points, with the yield on the ten-year BTP standing at 4.22%.

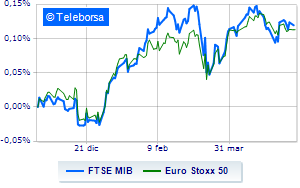

In the European stock market scenario cautious progress for Frankfurtshowing a performance of -0.12%, thoughtful London, a fractional decline of 0.34%; little moved Paris, which shows a -0.16%. In Milan, the FTSEMIB it is substantially stable and stands at 27,199 points; on the same line the FTSE Italia All-Share remains at 29,336 points.

Between best performers of Milan, in evidence MPS Bank (+4.24%), Phinecus (+2.08%), STMicroelectronics (+1.86%) and ERG (+1.58%).

The strongest sales, on the other hand, show up amplifierwhich continues trading at -2.27%.

They focus their sales on Telecom Italywhich suffers a drop of 1.61%.

He hesitates CNH Industrialwith a modest drop of 1.41%.

It’s moving modestly up Prysmianshowing an increase of 1.24%.

Among the protagonists of the FTSE MidCap, doValue (+11.44%), Intercos (+3.79%), De Nora Industries (+3.41%) and GV extension (+2.51%).

The worst performances, however, are recorded on Drywhich gets -3.29%.

Basically unchanged Datalogicwhich reports a moderate -0.07%.

Stay close to parity OVS extension (-0.07%).

Fly MARRwith a marked rise of 13.88%.