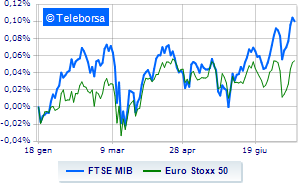

(Tiper Stock Exchange) – Negative session for the main European stock exchanges, while the square in Milan is positioned just below the parity line. The negative performance of the Asian stock exchanges contributed to penalizing the continental markets, in the wake of the disappointing Chinese GDP and retail sales data.

L’Euro / US Dollar the session continued at the previous levels, reporting a variation of -0.11%. L’Gold the session continued at the previous levels, reporting a variation of -0.01%. The oil market was substantially stable, continuing the session at the levels seen on the eve with oil (Light Sweet Crude Oil) trading at 75.11 dollars per barrel.

Consolidate the levels of the eve lo spreadssettling at +169 basis points, with the yield on the ten-year BTP standing at 4.15%.

Among the main European Stock Exchanges essentially weak Frankfurtwhich records a decrease of 0.32%, remains close to parity London (-0.18%), stronger sales a Pariswhich suffers a drop of 1.13%.

No significant changes for the Milanese price listwith the FTSEMIB which is slightly below the previous day’s values at 28,639 points; along the same lines, stay flat the FTSE Italia All-Share, with the quotations standing at 30,667 points. Negative changes for the FTSE Italia Mid Cap (-1.12%); along the same lines, down the FTSE Italy Star (-0.76%).

Between best performers of Milan, in evidence BPM desk (+1.62%), Leonardo (+1.51%), CNH Industrial (+1.24%) and BPER (+1.03%).

The strongest sales on Monclerwhich continues trading at -4.19%.

Bad Interpumpwhich records a drop of 3.02%.

Bad sitting for STMicroelectronicswhich shows a loss of 1.55%.

Under pressure Campariwhich shows a drop of 1.51%.

Among the protagonists of the FTSE MidCap, Cembre (+4.29%), Banca Popolare di Sondrio (+1.88%), Saras (+1.64%) and believe (+1.47%).

The strongest declines, however, occur on Eurogroup Laminationswhich continues the session with -12.44%.

It collapses Brunello Cucinelliwith a drop of 4.79%.

Slide Ariston Holdingwith a clear disadvantage of 3.34%.

In red Tod’swhich shows a marked decrease of 2.42%.