(Finance) – Asian stock markets move in a mixed manner, in a session characterized however by weakness. Investors are expecting signals from this week’s Federal Reserve meeting after Wall Street’s heavy sell-off on Friday. On the macroeconomic front, themanufacturing activity in Japan it continued to grow in January. Some stocks in the real estate sector move upwards on the Chinese stock exchanges: Evergrande runs for the new board appointments, while Agile and Shimao for the sale of some assets.

Tokyo

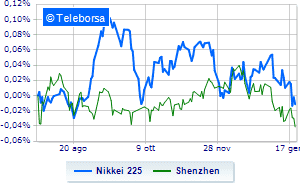

continue the session with a fractional gain on Nikkei 225 0.24%; on the same line, theShenzhen index advances fractionally, reaching 14,068 points, while Shanghai moves on parity. Negative changes for Hong Kong (-1.16%); on the same line, down Seoul (-1.49%). Depressed the market of Mumbai (-2.05%); with similar direction, under par Sydneywhich shows a decrease of 0.65%.

“Markets trade cautiously ahead of the FOMC statement This week, which is expected to be aggressive and potentially outline interest rate hikes starting in March, ANZ Research analysts wrote in a statement. They doubt the Fed can put an end to quantitative easing this week. “We’re even doubtful that the Fed could begin to tighten policy with a 50 basis point rate hike. Markets could stabilize if the Fed is not as aggressive as some fears suggest, “ANZ analysts added.

Flattened the performance ofEuro against the Japanese currency, which deals with a modest -0.13%. Fractional discount forEuro against the Chinese currency, which trades with a loss of 0.29%. Substantial invariance for theEuro versus Hong Kong Dollarwhich changed hands with a negligible -0.19%.

The yield ofJapanese ten-year bond is equal to 0.14%, while the yield of ten-year Chinese government bond trade 2.69%.

Between macroeconomic variables most important in Asian markets:

Monday 24/01/2022

01:30 Japan: Manufacturing PMI (expected 55 points; preceding 54.3 points).