(Finance) – Milan closes weakly, in the wake of the other Euroland stock exchanges. On Wall Street, theS & P-500 trading continues to decline after the job boom in the US, well above expectations, which reinforces the hypothesis of a more aggressive Fed on interest rate hikes to curb inflation.

On the currency market, minus sign forEuro / US dollar, in a session characterized by large sales (-0.82%). Reverse thegold, which slips to $ 1,775 an ounce. Rain of purchases on oil (Light Sweet Crude Oil), which shows a gain of 1.93%.

The Spread improves, reaching +202 basis points, with a decrease of 8 basis points compared to the previous value, with the yield of the ten-year BTP equal to 2.91%.

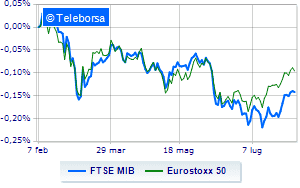

Among the markets of the Old Continent hesitates Frankfurtwith a modest fall of 0.65%, it remains close to par London (-0.11%); slow day for Paris, which marks a decrease of 0.63%. Caution prevails in closing in Piazza Affari, with the FTSE MIB which closes the session with a slight decrease of 0.26%; along the same lines, it yields to sales the FTSE Italia All-Sharewhich closed at 24,727 points.

At the close of the Milan Stock Exchange, the exchange value in today’s session it was equal to 1.47 billion euro, a marked decrease (-21.38%), compared to the previous session which had seen the negotiation of 1.87 billion euro; while the volumes traded went from 0.6 billion shares of the previous session to today’s 0.47 billion.

Between best performers of Milan, in evidence BPER (+ 9.70%), Pirelli (+ 4.30%), Unipol (+ 2.14%) e Telecom Italia (+ 1.85%).

Stronger sales, on the other hand, fell on Amplifonwhich ended trading at -5.36%.

Heavy DiaSorinwhich marks a drop of -3.77 percentage points.

Negative sitting for Campariwhich falls by 3.74%.

Sensitive losses for Ternadown 3.39%.

Top of the ranking of mid-cap stocks from Milan, Safilo (+ 5.13%), Credem (+ 3.01%), Carel Industries (+ 2.79%) e Danieli (+ 1.42%).

The strongest declines, on the other hand, occurred on Saraswhich closed the session at -7.89%.

Breathless Illimity Bankwhich falls by 6.92%.

Sales focus on MPS Bankwhich suffers a decline of 6.74%.

Thud of doValuewhich shows a fall of 4.28%.

Between macroeconomic quantities most important:

Friday 05/08/2022

half past one Japan: Real household expenses, monthly (expected 0.2%; previous -1.9%)

08:00 Germany: Industrial production, monthly (expected -0.3%; previous -0.1%)

08:45 France: Employment, quarterly (previous 0.3%)

08:45 France: Industrial production, monthly (expected -0.2%; previous 0.2%)

08:45 France: Current items (formerly -3.7 billion euros).