(Finance) – Sales rain on the US price list that widens the decline in the start-up thanks to some disappointing quarterly reports, especially from big techs such as Amazon and Apple. The nervousness among investors is also dictated in view of the new rate hike by the Federal Reserveexpected next week, while fears remain in the background for the dragging of the war in Ukraine.

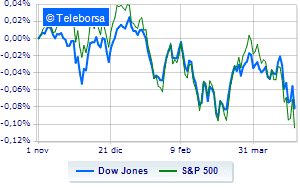

Among the US indices, the Dow Jones is trading with a heavy decline of 1.57%; along the same line, theS & P-500, which continues the session at 4,193 points. In sharp decline the Nasdaq 100 (-2.7%); on the same trend, heavy theS&P 100 (-2.48%).

Negative result on Wall Street for all sectors of the S&P 500. In the list, the worst performances are those of the sectors secondary consumer goods (-4.35%), informatics (-2.32%) e utilities (-2.03%).

The only Blue Chip of the Dow Jones is substantially increasing Honeywell International (+ 2.58%).

The strongest sales, on the other hand, show up on Intelwhich continues trading at -6.14%.

Bad performance for Verizon Communicationwhich recorded a decline of 3.68%.

Black session for Walgreens Boots Alliancewhich leaves a 3.05% loss on the table.

At a loss Salesforcewhich falls by 2.92%.

On the podium of the Nasdaq titles, Pinduoduo Inc Spon Each Rep (+ 16.50%), JD.com (+ 8.08%), NetEase (+ 5.93%) e Baidu (+ 5.68%).

The worst performances, on the other hand, are recorded on Verisignwhich gets -13.16%.

Heavy Amazonwhich marks a drop of -13.14 percentage points.

Negative sitting for Atlassianwhich falls by 11.13%.

Sensitive losses for Charter Communicationsdown 9.51%.

Between the data relevant macroeconomics on US markets:

Friday 29/04/2022

14:30 USA: Labor cost index, quarterly (expected 1.1%; previous 1%)

14:30 USA: Personal expenses, monthly (expected 0.7%; previous 0.6%)

14:30 USA: Personal income, monthly (expected 0.4%; previous 0.7%)

15:45 USA: PMI Chicago (expected 62 points; preceding 62.9 points)

4:00 pm USA: University of Michigan Consumer Confidence (expected 65.7 points; preceded 59.4 points).