(Finance) – At its November meeting, the Federal Reserve will raise interest rates by 0.75 basis points and will discuss the next steps to be taken, in particular on the extent of future increases.

According to what the Wall Street Journal, some Fed officials would have begun to emphasize the need to slow the speed of rate hikes and stop next year to assess the effect of decisions on the economy, so as to avoid the risk of a sharp slowdown. Others, on the other hand, believe that it is too early to think of a slowdown given the high inflation.

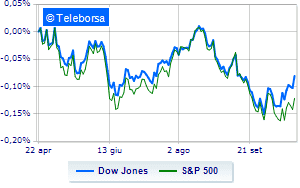

The possibility of a milder Fed on monetary policy is lending support to US equity indices turning in positive territory after a weak start. The Dow Jones it is achieving + 0.62%; along the same lines, slight increase forS & P-500, which rises to 3,681 points. Consolidate eve levels on Nasdaq 100 (+ 0.02%); moderately up theS&P 100 (+ 0.36%).

In the S&P 500, the sub-funds performed well power (+ 1.05%), materials (+ 1.04%) e sanitary (+ 0.67%). The sector telecommunicationswith its -1.17%, it is the worst of the market.

Among the best Blue Chips of the Dow Jones, Walgreens Boots Alliance (+ 2.26%), DOW (+ 1.98%), JP Morgan (+ 1.93%) e Cisco Systems (+ 1.92%).

The strongest sales, on the other hand, show up on American Expresswhich continues trading at -6.69%.

Goes down Verizon Communicationwith a drop of 5.70%.

Under pressure Salesforcewith a sharp fall of 1.06%.

Basically weak Boeingwhich recorded a decrease of 0.66%.

Between best performers of the Nasdaq 100, Modern (+ 4.84%), Netflix (+ 2.39%), Micron Technology (+ 2.35%) e Walgreens Boots Alliance (+ 2.26%).

The strongest sales, on the other hand, show up on Matchwhich continues trading at -5.15%.

Collapses NetEasewith a decrease of 4.67%.

Sales hands on Datadogwhich suffers a decrease of 4.54%.

Bad performance for Zscalerwhich recorded a decline of 4.38%.

Among macroeconomic appointments which will have the greatest influence on the performance of the US markets:

Monday 24/10/2022

15:45 USA: Manufacturing PMI (preceding 52 points)

15:45 USA: SME services (preceding 49.3 points)

15:45 USA: Composite PMI (preceding 49.5 points)

Tuesday 25/10/2022

15:00 USA: S&P Case-Shiller, annual (previous 16.1%)

15:00 USA: FHFA house price index, monthly (previous -0.6%).