(Finance) – The session on Wall Street continues to fall after an initial optimism from investors supported byeasing of restrictions in China for Covid-19, which pushed in particular the titles related to the travel sector: such as Wynn Resorts And Las Vegas Sandsbut also American, United And Delta Air Lines.

The attention of the insiders remains then turned to American banks, in particular to the institutions that have decided to raise dividends after passing the Federal Reserve’s stress tests: Bank of America Morgan Stanley, Goldman Sachs And Wells Fargo.

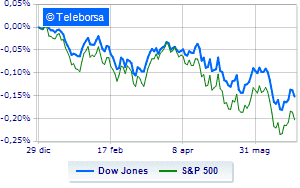

Among the US indices, the Dow Jones it is down (-0.97%) and stands at 31,134 points; on the same line, a bad day for theS & P-500, which continues the session at 3,844 points, down 1.44%. The Nasdaq 100 (-2.36%); on the same trend, very bad theS&P 100 (-1.68%).

Positive result in the S&P 500 basket for the sector power. Among the worst on the list of the S&P 500 basket, the sectors showed the greatest decline secondary consumer goods (-3.16%), telecommunications (-2.29%) e informatics (-2.21%).

At the top of the ranking of American giants components of the Dow Jones, Travelers Company (+ 1.20%), Chevron (+ 1.05%), DOW (+ 1.05%) e Boeing (+ 0.98%).

The strongest sales, on the other hand, show up on Nikewhich continues trading at -5.45%.

Goes down Salesforcewith a decline of 4.51%.

Collapses Home Depotwith a decrease of 3.43%.

Sales hands on Johnson & Johnsonwhich suffers a decrease of 2.85%.

Between protagonists of the Nasdaq 100, Qualcomm (+ 5.39%), Xcel Energy (+ 1.07%) e American Electric Power (+ 0.56%).

The strongest sales, on the other hand, show up on Datadogwhich continues trading at -7.56%.

Bad performance for Mercadolibrewhich records a decline of 6.60%.

Black session for Docusignwhich leaves a loss of 6.60% on the table.

At a loss Zscalerwhich falls by 6.27%.

Between the data relevant macroeconomics on US markets:

Tuesday 28/06/2022

14:30 USA: Wholesale stocks, monthly (expected 2.1%; previous 2.3%)

15:00 USA: S&P Case-Shiller, annual (expected 21%; previous 21.1%)

15:00 USA: FHFA house price index, monthly (previous 1.6%)

4:00 pm USA: Consumer confidence, monthly (100.4 points expected; previous 106.4 points)

Wednesday 29/06/2022

14:30 USA: GDP, quarterly (expected -1.5%; previous 6.9%).