(Finance) – After yesterday’s negative session, in which the Nasdaq which left 4% on the ground, Wall Street tries to rebound. To weigh on investor sentiment are the escalation of tension between the West and Moscow on the invasion of Ukraine and the quarterly season, with many multinationals releasing results in the dark. Last night, with markets closed, they announced the results for the first quarter Microsoft (which forecast double-digit revenue growth for the next fiscal year, driven by demand for cloud computing services) and Alphabet (with Google’s parent company missing revenue expectations as the war in Ukraine hurt YouTube ad sales).

In today’s session, eyes will also be on Boeingwhich registered a broader quarterly loss last year and reported higher costs and delays in the development of some aircraft, e Mattelwith the Wall Street Journal reporting on theinvolvement of private equity companies for the toy manufacturer, e Visawhich posted a positive quarter, helped by a rebound in consumer spending.

“THE corporate profit margins in America may have peaked and start to decline somewhat – commented Matthew Benkendorf, CIO boutique Quality Growth at Vontobel – The chip shortage illustrates how interdependent markets are and how deglobalization can have profound impacts that are difficult to fully predict. Investors should be wary that the record profit margins enjoyed by US companies could return to average. “

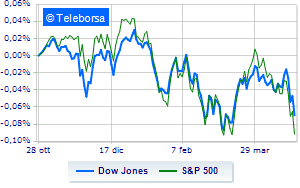

Slight increase for the New York Stock Exchangewhich shows on the Dow Jones an increase of 0.40%; along the same lines, slight increase forS & P-500, which brings to 4,194 points. Positive the Nasdaq 100 (+ 0.75%); on the same line, just above parity, theS&P 100 (+ 0.48%).

Noticeable upside in the S&P 500 for i compartments informatics (+ 1.74%), secondary consumer goods (+ 1.24%) e materials (+ 1.04%). The sector telecommunicationswith its -2.13%, it is the worst of the market.

Among the best Blue Chips of the Dow Jones, Visa (+ 8.01%), Microsoft (+ 4.23%), Salesforce (+ 2.13%) e Home Depot (+ 1.56%).

The worst performances, on the other hand, are recorded on Boeingwhich gets -6.72%.

Sales on Walgreens Boots Alliancewhich recorded a decline of 1.21%.

Modest descent for Cisco Systemswhich yields a small -0.75%.

Thoughtful Merckwith a fractional decline of 0.71%.

To the top between tech giants of Wall Streetthey position themselves Pinduoduo Inc Spon Each Rep (+ 6.00%), JD.com (+ 5.53%), Lucid (+ 4.90%) e Datadog (+ 4.63%).

The strongest sales, on the other hand, show up on Alphabetwhich continues trading at -3.50%.

Thud of Alphabetwhich shows a 3.33% drop.

Letter on Texas Instrumentswhich records a significant decline of 2.18%.

Negative sitting for Walgreens Boots Alliancewhich shows a loss of 1.21%.

Between the data relevant macroeconomics on US markets:

Wednesday 27/04/2022

14:30 USA: Wholesale stocks, monthly (previous 2.5%)

4:00 pm USA: Home sales in progress, monthly (expected -1.6%; previous -4.1%)

16:30 USA: Oil stocks, weekly (2 million barrels expected; previously -8.02 million barrels)

Thursday 28/04/2022

14:30 USA: Unemployment Claims, Weekly (Expected 180K Units; Previously 184K Units)

14:30 USA: GDP, quarterly (1.1% expected; previously 6.9%).