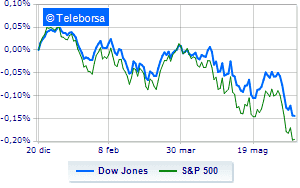

(Finance) – The Wall Street stock market continues to rise after a session on the eve of strong drops. The weekly budget, however, will be in the red. To weigh on investor sentiment is above all the aggressive squeeze by the Federal Reserve against the high inflation that could bring the United States in recessionwith consequences on global markets.

Among the US indices, the Dow Jones shows a fractional gain of 0.32%; on the same line, theS & P-500 advances fractionally, reaching 3,692 points. The Nasdaq 100 (+ 1.84%); as well, positive theS&P 100 (+ 0.81%).

In the S&P 500, the sub-funds performed well secondary consumer goods (+ 1.84%), telecommunications (+ 1.76%) e informatics (+ 1.74%). In the list, the sectors power (-6.04%) e utilities (-1.01%) are among the best sellers.

At the top of the ranking of American giants components of the Dow Jones, American Express (+ 5.11%), Salesforce (+ 3.89%), Boeing (+ 3.71%) e Microsoft (+ 2.18%).

The worst performances, on the other hand, are recorded on Chevronwhich gets -6.07%.

Thud of DOWwhich shows a drop of 2.27%.

Under pressure Wal-Martwith a sharp decline of 1.49%.

Suffers Merckwhich shows a loss of 1.12%.

Between best performers of the Nasdaq 100, Seagen (+ 16.20%), Docusign (+ 8.13%), AirBnb (+ 7.28%) e Zscaler (+ 6.85%).

The strongest sales, on the other hand, show up on Matchwhich continues trading at -3.82%.

Letter on Kraft Heinzwhich records a significant decline of 2.66%.

Goes down Constellation Energywith a fall of 2.22%.

Prey of the sellers Xcel Energywith a decrease of 1.54%.

Between the data relevant macroeconomics on US markets:

Friday 17/06/2022

15:15 USA: Industrial production, monthly (expected 0.4%; previous 1.4%)

15:15 USA: Industrial production, annual (previous 6.4%)

4:00 pm USA: Leading indicator, monthly (expected -0.4%; previous -0.4%)

Tuesday 21/06/2022

4:00 pm USA: Sale of existing homes, monthly (previous -2.4%)

Thursday 23/06/2022

14:30 USA: Unemployment Claims, Weekly (Previous 229K Unit).