(Tiper Stock Exchange) – Wall Street moves higherafter positive quarterly results of some of the largest banks in the country. Today’s session is the icing on the cake of an extremely positive week for the majority of assets, thanks to the hope that the United States is heading towards a “Goldilocks scenario”, a situation in which low but solid growth is combined with a inflation, thus avoiding a dangerous recession.

With regards tostart of the quarterly season, JPMorgan closed the second quarter of 2023 with net income up 67% to $14.47 billion, Wells Fargo with net income up 57% to $4.94 billion, citigroup with net income down 36% to $2.9 billion.

Among other results released before the opening of the market, BlackRock communicated growth in assets under management (AUM) to $9.43 trillion, while UnitedHealth boosted the lower end of full-year earnings guidance.

On the front of monetary policy, Mary Daly (San Francisco) said the economy still has momentum, and that the Fed should start moving towards the neutral interest rate as inflation approaches the 2% target. Christopher Waller He said the strength of the labor market and the overall strength of the economy create room for further monetary policy tightening, adding that he welcomes two more 25 basis point Fed rate hikes this year.

Among the securities affected by analyst recommendationsPlug Power benefits from an upgrade to outperform from Northland Capital Markets, Microsoft from an upgrade from UBS to buy, AT&T suffers a downgrade to neutral from JPMorgan, while Alcoa a downgrade to neutral from JPMorgan.

On the macroeconomic frontimport-export prices fell in June 2023, the Bureau of Labor Statistics reported today.

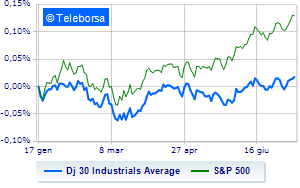

Looking to main indicesthere is a gain on the Dow Jones by 0.42%, continuing the bullish trail highlighted by five consecutive gains, triggered last Monday; along the same lines, theS&P-500 it advances fractionally, reaching 4,521 points. Moderately up the NASDAQ 100 (+0.54%); as well, slightly positive theS&P 100 (+0.49%).