(Finance) – Wall Street moves positivelyafter heavy sell-off from yesterday. Investors find themselves evaluating the many signals from central banks around the world this week and the effects of monetary policy decisions on growth and inflation. The market may show some volatility today due to the Day of the Four Witchesi.e. the simultaneous expiration of Stock Index Futures, Single Stock Futures, Stock Index Options and Stock Options.

The chairman of the Federal Reserve, Jerome Powellsaid today he was “highly focused on returning inflation to our 2% target.”

On the macroeconomic front, both analysts’ expectations are disappointing industrial production which manufactured in the United States in May 2022.

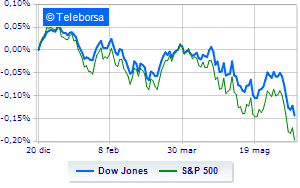

The Dow Jones rises by 0.25% to 30,001 points; on the same line, theS & P-500 proceeds in small steps, advancing to 3,685 points. Good performance of the Nasdaq 100 (+ 0.93%); with a similar direction, theS&P 100 (+ 0.49%).

In good evidence in the S&P 500 i compartments sanitary (+ 1.08%), telecommunications (+ 0.90%) e informatics (+ 0.63%). At the bottom of the ranking, significant falls are manifested in the sector powerwhich reports a decrease of -1.61%.

At the top of the ranking of American giants components of the Dow Jones, Walgreens Boots Alliance (+ 1.39%), Coke (+ 1.32%), Microsoft (+ 1.21%) e Cisco Systems (+ 1.15%).

The strongest sales, on the other hand, show up on Chevronwhich continues trading at -1.70%.

Decline for Visawhich marks a -1.08%.

He hesitates Nikewhich yields 0.84%.

Basically weak Goldman Sachswhich recorded a decrease of 0.67%.

Between protagonists of the Nasdaq 100, JD.com (+ 5.95%), Pinduoduo Inc Spon Each Rep (+ 4.72%), Seagen (+ 4.67%) e Baidu (+ 3.85%).

The worst performances, on the other hand, are recorded on Adobe Systemswhich gets -4.42%.

Under pressure Matchwith a sharp decline of 1.75%.

Suffers Dollar Treewhich shows a loss of 1.19%.

It moves below par CSXshowing a decrease of 0.72%.

Between macroeconomic quantities most important of the US markets:

Friday 17/06/2022

15:15 USA: Industrial production, monthly (expected 0.4%; previous 1.4%)

15:15 USA: Industrial production, annual (previous 6.4%)

4:00 pm USA: Leading indicator, monthly (expected -0.4%; previously -0.3%)

Tuesday 21/06/2022

4:00 pm USA: Sale of existing homes, monthly (previous -2.4%)

Thursday 23/06/2022

14:30 USA: Unemployment Claims, Weekly (Previous 229K Unit).