(Finance) – A sudden change of direction for the Wall Street stock exchange which pushes on the accelerator, bringing the American indices to the session highs after the words of the Fed President, Jerome Powell, who spoke of declining inflation.

Speaking at the Economic Club of Washington, the banker underlined that more rate hikes will probably be needed interest rates and that the Federal Reserve has no intention of changing its inflation target to 2%. It will take until 2024 for inflation to drop close to 2%, but 2023 “will be a year of significant price declines”.

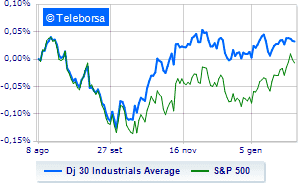

The US indices, after having spent the first part of the session in the name of caution, have started to rise: the Dow Jones shows a gain of 0.72% thus blocking the bearish trail supported by three consecutive declines, which started last Thursday; along the same lines, theS&P-500 the day continues with an increase of 1.10%. Significant improvement NASDAQ 100 (+1.77%); as well as, rising theS&P 100 (+1.26%).

Between protagonists of the Dow Jones, Microsoft (+3.50%), boeing (+2.64%), Chevrons (+1.96%) and Apple (+1.43%).

The worst performances, however, are recorded on Verizon Communicationwhich gets -1.64%.

Slide Home Depotwith a clear disadvantage of 1.57%.

Thoughtful Caterpillara fractional decline of 0.96%.

He hesitates McDonald’swith a modest decline of 0.75%.

On the podium of the Nasdaq stocks, Skyworks Solutions, (+11.16%), Baidu (+10.80%), Zoom Video Communications, (+9.89%) and Fiserv, (+7.83%).

The strongest declines, however, occur on Lucid Group,which continues the session with -4.09%.

In red Ross Storeswhich shows a marked decrease of 2.10%.

The negative performance of Mercadolibre,which drops by 1.93%.

Mondelez International drops by 1.81%.

Among the data relevant macroeconomics on US markets:

Tuesday 07/02/2023

2.30pm USA: Trade Balance (Expected -68.5 Bn $; Previous -61 Bn $)

Wednesday 08/02/2023

4:00 pm USA: Inventories wholesale, monthly (exp. 0.1%; prev. 1%)

4.30pm USA: Oil Inventories, Weekly (exp. 376K barrels; prev. 4.14M barrels)

Thursday 09/02/2023

2.30pm USA: Initial Jobless Claims, Weekly (Expected 194K; Previously 183K)

Friday 10/02/2023

4:00 pm USA: University of Michigan Consumer Confidence (expected 64 points; previous 64.9 points).