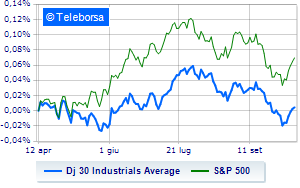

(Finance) – In New York, the Dow Jones, which drops to 33,635 points, with a percentage difference of 0.31%, breaking the positive chain of three consecutive increases, which began last Friday; along the same lines, theS&P-500 it has a depressed trend and trades below the levels of the day before at 4,349 points. On the levels of the day before the Nasdaq 100 (+0.08%); along the same lines, consolidates the levels of the day beforeS&P 100 (-0.09%).

Investors’ attention is focused on the key data of the week: inflation which will be published tomorrow. Meanwhile, Fed Governor Michelle Bowman reiterated that despite “some progress” on inflation, the central bank will likely need to tighten monetary policy further to restore price stability.

The sectors highlighted on the North American S&P 500 list utilities (+0.85%) e telecommunications (+0.69%). In the price list, the sectors power (-1.80%), office consumables (-0.90%) e healthcare (-0.77%) are among the best sellers.

Among the best Blue Chips of the Dow Jones, Amgen (+4.70%), Nike (+0.93%), Boeing (+0.83%) e Walgreens Boots Alliance (+0.83%).

The strongest sales, however, occur at Chevronwhich continues trading at -2.61%.

Lame Dowwhich shows a small decrease of 1.37%.

Modest descent for Coca Colawhich drops a small -1.36%.

Thoughtful Procter & Gamblewith a fractional decline of 1.24%.

On the podium of Nasdaq stocks, Amgen (+4.70%), Adobe Systems (+3.17%), CrowdStrike Holdings (+1.60%) e Enphase Energy (+1.51%).

The worst performances, however, are recorded on DexComwhich gets -7.15%.

Breathless Intuitive Surgicalwhich fell by 4.91%.

Under pressure Keurig Dr Pepperwhich suffered a decline of 3.38%.

It slides Align Technologywith a clear disadvantage of 3.02%.