(Finance) – A cautious upward start for the Wall Street stock exchange with the eyes of investors focused on central banks. The next Federal Reserve meeting is scheduled for September 20-21 and the FOMC – the Fed’s monetary policy arm – will likely decide to raise rates by 75 basis points for the third consecutive time.

At the end of the day, the American central bank will publish the Beige Bookthe usual report drawn up every six weeks based on information collected in the 12 districts in which the Fed operates.

On the macro front, the US trade balance deficit decreased in July but less than expected. Attention shifts to the data, arriving next week, which concerns US consumer prices and which, in all likelihood, will influence the decisions of the Fed in the September meeting.

On the corporate side, focus on the stock Apple which will feature the launch of the iPhone 14, the Apple Watch Series 8 and an update to the iOS operating system.

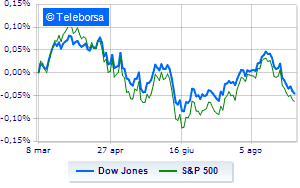

Among the US indices, the Dow Jones continues the session at the levels of the eve and stops at 31.206 points, while, on the contrary, theS & P-500 proceeds in small steps, advancing to 3,921 points. Good performance of the Nasdaq 100 (+ 0.75%); as well as, with a moderate increase inS&P 100 (+ 0.33%).

In the S&P 500, the sub-funds performed well utilities (+ 1.52%), secondary consumer goods (+ 0.89%) e telecommunications (+ 0.70%). The sector powerwith its -2.13%, it is the worst of the market.

Among the best Blue Chips of the Dow Jones, McDonald’s (+ 1.30%), Nike (+ 0.99%), Walt Disney (+ 0.97%) e Boeing (+ 0.87%).

The worst performances, on the other hand, are recorded on Chevronwhich gets -1.75%.

Suffers Merckwhich shows a loss of 1.23%.

He hesitates Walgreens Boots Alliancewhich yields 0.59%.

Between protagonists of the Nasdaq 100, Starbucks (+ 2.83%), Netflix (+ 2.35%), Exelon (+ 2.10%) e Constellation Energy (+ 1.98%).

The strongest sales, on the other hand, show up on Astrazenecawhich continues trading at -2.73%.

Prey of the sellers Kraft Heinzwith a decrease of 1.71%.

Sales focus on Old Dominion Freight Linewhich suffers a decline of 1.21%.

Basically weak Pinduoduo Inc Spon Each Repwhich recorded a decrease of 0.80%.

Between macroeconomic variables most important in the North American markets:

Wednesday 07/09/2022

14:30 USA: Balance of trade (expected -70.3 B $; previously -80.9 B $)

Thursday 08/09/2022

14:30 USA: Unemployment Claims, Weekly (Expected 240K Units; Previously 232K Units)

17:00 USA: Oil stocks, weekly (previous -3.33 Mln barrels)

Friday 09/09/2022

4:00 pm USA: Wholesale stocks, monthly (expected 0.8%; previous 1.8%)

Tuesday 13/09/2022

14:30 USA: Consumption prices, monthly (previous 0%).