(Finance) – Wall Street trades positively supported by tech giants. However, investors remain cautious pending the Jackson Hole Symposium, from which more detailed indications could emerge on the activity of central banks worldwide and above all of the Fed. Investors also find themselves evaluating various macroeconomic data, which offer a dark and dark picture of the US economy.

The core durable goods orders US factories rose more than expected in July, indicating sustained demand for equipment despite higher interest rates and concerns about a weakening economy. However, the overall reading was lower than expected. The mortgage applications Instead, they continued to remain at the lows of the last 22 years, held back by significantly reduced demand for refinancing and weak home purchase activity.

The sales of houses in progress in the United States, they declined again in July, with affordability of housing plummeting to its lowest level since 1989.

On the monetary policy front, the Friday speech by the president of the Fed at the Jackson Hole Symposium. Powell’s words could offer some clarity on the speed of upcoming rate hikes and his expectations of how high rates will need to rise before inflation is brought under control.

Meanwhile, an orientation hawkish came from the president of the Federal Reserve Bank of Minneapolis, Neel Kashkari. “With many, many measures we are at peak employment and we are at very high inflation. So this is a completely unbalanced situation, which means to me it is very clear: we need to tighten monetary policy to bring things back into balance, “he said at an event.

As regards the quarterly, Nordstrom (US giant of large retailers) has guidance revised downwards as customer traffic and demand decelerated significantly since the end of June, impacted by runaway inflation. Intuit instead he communicated a positive outlook for the current financial year and the buyback increased. Nvidia And Salesforce they will release the results after the market closes.

The leaps in the stock market stand out from Pelotonwho started selling their products on Amazon to expand the customer base, Farfetchwhich agreed to buy a large chunk of online retailer Yoox Net-A-Porter (YNAP) from Richemont at a reduced price, e Bed Bath & Beyondwhich allegedly found a source of funding to bolster its liquidity (according to a Wall Street Journal indiscretion).

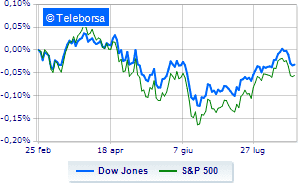

The New York Stock Exchange does not stray too far from paritywith the Dow Jones which stands at 32,940 points, while, on the contrary, a slight increase for theS & P-500, which rises to 4,138 points. Just above parity the Nasdaq 100 (+ 0.41%); on parity theS&P 100 (+ 0.15%). Secondary consumer goods (+ 0.80%) e telecommunications (+ 0.66%) in good light on the S&P 500 list.

At the top of the ranking of American giants components of the Dow Jones, Salesforce (+ 2.27%), Boeing (+ 1.86%), Walt Disney (+ 1.41%) e Nike (+ 1.26%).

The strongest sales, on the other hand, show up on Walgreens Boots Alliancewhich continues trading at -2.03%.

Thud of DOWwhich shows a drop of 2.01%.

Decline for Caterpillarwhich marks a -1.12%.

Under pressure 3Mwith a sharp decline of 1.10%.

Between protagonists of the Nasdaq 100, Illuminate (+ 7.98%), Pinduoduo Inc Spon Each Rep (+ 6.06%), JD.com (+ 5.00%) e Intuit (+ 4.52%).

The worst performances, on the other hand, are recorded on Walgreens Boots Alliancewhich gets -2.03%.

Suffers Microchip Technologywhich shows a loss of 1.37%.

Prey of the sellers Modernwith a decrease of 1.22%.

Sales focus on Analog Deviceswhich suffers a 1.02% decline.