(Finance) – Little movement on Wall Streeton the day the meeting of the Federal Open Market Committee (FOMC) of the US Federal Reserve. Expectations are that the central bank will keep interest rates stable, with attention tomorrow evening turning to Chairman Jerome Powell’s statement and comments. Meanwhile, the story continues quarterly seasonwith 77.7% of the 251 companies in the S&P 500 reporting earnings so far above analysts’ estimates, according to LSEG data reported by Reuters.

Among the big names who have spread the results before the bellstand out Pfizer (which missed expectations for the quarter as sales of the Covid-19 vaccine and Paxlovid pill continued to slump), Caterpillar (which reported a decline in order backlog, even as it reported earnings above analysts’ estimates) and VF (which withdrew its full-year revenue and profit forecasts, with demand slowing).

On the macroeconomic frontUS housing prices increased in August 2023 (both Federal Housing Finance Agency and S&P Case-Shiller data), US labor cost growth increased marginally in Q3 of 2023, manufacturing activity in the Chicago area worsened marginally, American consumer confidence decreased in October.

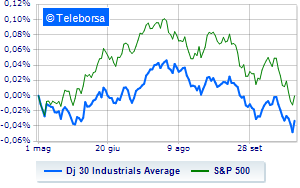

Looking at the main indicesThe Dow Jones stands at 32,981 points, while, on the contrary, a small leap forward for theS&P-500, which reaches 4,180 points. On equality the Nasdaq 100 (+0.13%); on the same trend, without direction theS&P 100 (+0.07%).

In good evidence in the S&P 500 i compartments utilities (+0.82%), financial (+0.78%) e industrial goods (+0.64%).

At the top of the rankings American giants components of the Dow Jones, Boeing (+2.15%), Honeywell International (+2.07%), 3M (+2.02%) e Intel (+1.74%).

The steepest declines, however, occur at Caterpillar, which continues the session with -6.26%. Prey for sellers Amgen, with a decrease of 3.47%. He hesitates Merck, with a modest decline of 1.10%. Slow day for Chevronwhich marks a decline of 0.81%.

To the top between Wall Street tech giantsthey position themselves GE Healthcare Technologies (+4.42%), Trade Desk (+4.41%), DexCom (+4.18%) e Electronic Arts (+2.49%).

The worst performances, however, are recorded on PDD Holdings, which gets -3.70%. They focus on sales Amgen, which suffers a decline of 3.47%. Sales up ON Semiconductor, which recorded a decline of 3.37%. Negative session for JD.comwhich shows a loss of 2.78%.