(Finance) – The Wall Street stock exchange crosses the mid-session mark in the name of prudence after Moody’s decision to lower the outlook on China’s rating to negative and awaiting the key data on employment, scheduled for Friday, to evaluate the Federal Reserve’s next moves.

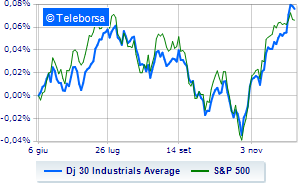

Among US indices, it moves below parity Dow Joneswhich drops to 36,116 points, with a percentage difference of 0.24%, while, on the contrary, theS&P-500, which continues the day at 4,564 points. Without direction the Nasdaq 100 (0%); fractional earnings forS&P 100 (+0.23%).

Appreciable increase in the S&P 500 for the sector informatics. Among the most negative on the S&P 500 list, we find the sectors materials (-1.19%), power (-1.06%) e industrial goods (-0.69%).

Among the best Blue Chips of the Dow Jones, Apple (+1.95%), Merck (+1.16%), Wal-Mart (+0.76%) e Microsoft (+0.74%).

The worst performances, however, are recorded on Procter & Gamblewhich gets -3.21%.

He suffers American Expresswhich highlights a loss of 2.22%.

Prey for sellers Goldman Sachswith a decrease of 2.04%.

They focus on sales Walt Disneywhich suffers a drop of 1.90%.

Between best performers of the Nasdaq 100, Apple (+1.95%), Tesla Motors (+1.79%), Palo Alto Networks (+1.46%) e Nvidia (+1.40%).

The strongest sales, however, occur at Charter Communicationswhich continues trading at -8.02%.

Heavy Warner Bros Discoverywhich marks a decrease of -4.39 percentage points.

Negative session for Paypalwhich fell by 4.16%.

Sales up Comcast Corporationwhich recorded a decline of 3.62%.

Wednesday 06/12/2023

2.15pm USA: ADP employed (expected 128K units; previously 113K units)

2.30pm USA: Trade balance (expected -$64.1 billion; previously -$61.5 billion).