(Finance) – The Wall Street stock market continues to fall with the focus of investors remaining concentrated on central banks. The market is still digesting the comments from the New York and St. Louis Fed presidents who underlined the need to continue the policy of interest rate hikes to cool down inflation. Also there ECB he reiterated that the peak of inflation is still far off.

Expected the speech by Fed head Jerome Powell who will speak tomorrow and from whom confirmation of a slowdown in the rate of tightening on the cost of money is expected, while recalling that the fight against inflation will also continue in 2023.

Meanwhile, expectations are growing of an easing of the anti Covid restrictions in China in light of the growing civil unrest in the country. While Beijing has refrained from announcing any concrete steps towards reopening the country, it has pledged to strengthen vaccinations among older citizens, a move seen as crucial to ending strict restrictions.

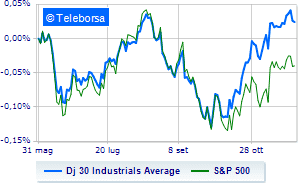

Among US indices, the Dow Jones it stands at 33,804 points with a decrease of approximately 1%; along the same lines, theS&P-500 drops 1.16% while the NASDAQ 100 loses 0.86%.

Between macroeconomic quantities most important of the US markets:

Tuesday 11/29/2022

3pm USA: FHFA House Price Index, Monthly (exp. -1.2%; previous -0.7%)

3pm USA: S&P Case-Shiller, annual (exp. 10.8%; previously 13.1%)

4:00 pm USA: Consumer confidence, monthly (expected 100 points; previous 102.2 points)

Wednesday 11/30/2022

2.15pm USA: Occupied ADP (Expected 203K units; Previous 239K units)

2.30pm USA: Wholesale inventories, monthly (previously 0.6%).