(Finance) – The Wall Street Stock Exchange moves cautiously on the day when the Federal Reserve Chairman Jerome Powell, speaking at an event in Sweden, gave no indication of the future path of interest rates in the United States of America. Investors were therefore disappointed who found no indications in the banker’s words for evaluating the next moves of the American central bank in terms of monetary policy.

Powell, speaking at a Swedish Riksbank symposium, stressed the importance of price stability and the need to continue working to bring inflation back to the 2% target. Following last week’s US labor market data, markets expected to understand whether or not expectations of a less aggressive Fed on interest rates were justified.

There is waiting now for the publication, Thursday 12 January, of the consumer price index Americans in December which will give important indications on the inflation trend in the United States, also providing some signals on the possible next moves of the stars and stripes central bank.

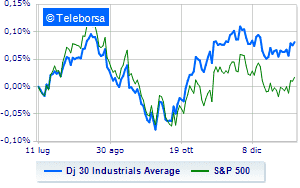

Among US indices, the Dow Jones shows a timid gain of 0.21%; along the same lines, theS&P-500 proceeds in small steps, advancing to 3,904 points. Fractional earnings for the NASDAQ 100 (+0.37%); as well as, moderately rising theS&P 100 (+0.27%).

All sectors slide on the American S&P 500 list.

To the top between Wall Street giants, Amgen (+1.11%), Goldman Sachs (+1.03%), Caterpillar (+0.89%) and Visa (+0.87%).

The strongest sales, on the other hand, show up United Healthwhich continues trading at -1.25%.

Disappointing boeingwhich lies just below the levels of the eve.

Slack Cokewhich shows a small decrease of 0.57%.

Between best performers of the Nasdaq 100, NetEase (+3.89%), Netflix (+3.19%), Idexx Laboratories, (+3.14%) and Regeneron Pharmaceuticals (+2.95%).

The strongest sales, on the other hand, show up light up,which continues trading at -5.60%.

Sales on broadcomwhich records a drop of 3.04%.

Bad sitting for Fortinet,which shows a loss of 2.57%.

Under pressure Crowdstrike Holdings,which shows a drop of 2.53%.

Between macroeconomic variables of greatest weight in the North American markets:

Tuesday 10/01/2023

4:00 pm USA: Inventories wholesale, monthly (exp. 1%; prev. 0.6%)

Wednesday 11/01/2023

5pm USA: Oil Inventories, Weekly (previously 1.69 Mln barrels)

Thursday 12/01/2023

2.30pm USA: Consumption prices, annual (expected 6.5%; previous 7.1%)

2.30pm USA: Consumption prices, monthly (expected 0.1%; previous 0.1%)

2.30pm USA: Initial Jobless Claims, Weekly (Expected 220K; Previously 204K).